In Italy there is no fundraising “conference” – no dull meeting of people saying the same old, same old.

But there is a Festival. The Festival del Fundraising took place this year on the shores of Lake Garda, near Verona. With 650 participants it was bigger this year than ever before, and it launched the festival mood with “Fundraiser’s Got Talent” an opening session in full Italian TV-show style. This is a young and growing fundraising market with a strong backbone of training, thanks to the Masters in Fundraising offered by the University of Bologna. This year there was an invited group of students from the Columbia University MSc in Fundraising Management, so the conversations in class and around the bar were cross-cultural: everyone learned from each other.

Italy’s NGOs, universities, arts and cultural organisations are increasingly looking to fundraising for growth. The Italian state is cutting back, and there is a hunger for doing more and better. Leading NGOs have focused in the past on direct mail marketing but many are developing DRTV and new media methods, and a few are focusing on strategic (major) donors.

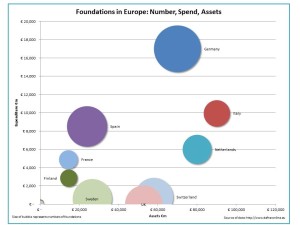

I gave a master class on foundations in Europe. The Italian foundation sector is significant – the largest in Europe by assets. [See figure]

Why so large? Principally thanks to a handful of mega-foundations created when the Italian Government split the huge regional savings banks which had previously carried out a mixed banking and social role, into banks, and foundations. Thus the Fondazione Cariplo has €7.7 billion in assets, while Fondazione CRT, built from the old savings bank of Turin has €2.2 billion. These huge foundations are relatively easy to find but the rest of the sector remains a mystery. There are thousands of foundations in Italy including family and church foundations which are almost completely invisible, and certainly do not have the type of glass pockets that would be expected amongst US or UK foundations.

The lack of transparency amongst strategic donors was a common theme in the conference – many donors do not want their name published nor their gift known. There are many reasons for this including, according to one speaker, the Catholic culture of separating philanthropy from the rest of one’s public life. This tendency to secrecy has been exacerbated by a new tool being used by the Italian tax authorities for measuring individual wealth: part of the measure is how much you give to charity. If you give a lot it is assumed that you have a lot, and people of wealth are concerned that this will mean they end up paying a lot more tax.

There are also problems of recruitment in this young and growing market. In the strategic donor area there are very few fundraisers with experience of strategic donor or foundation work, and almost none with prospect research experience. Setting up a team involves difficult choices between waiting to recruit someone experienced or training a newcomer. Salaries in the sector are still modest and so it is especially hard to recruit people with experience from relevant commercial sectors such as finance and banking.

The strong foundation of the Master in Fundraising at Bologna combined with a sector that wants to grow and the enthusiasm of hundreds of Italian fundraisers means that this is an exciting development market for fundraising. It is now time for the philanthropic sector to respond by moving toward a modern, transparent, accountable style of giving. Then we can have a real festival of fundraising.

Thanks to Columbia University and Valerio Melandri at the Festival del Fundraising / University of Bologna for the opportunity to speak at this event.

Factary is active in Italy, where we have carried out research, training and consultancy assignments for leading NGOs.