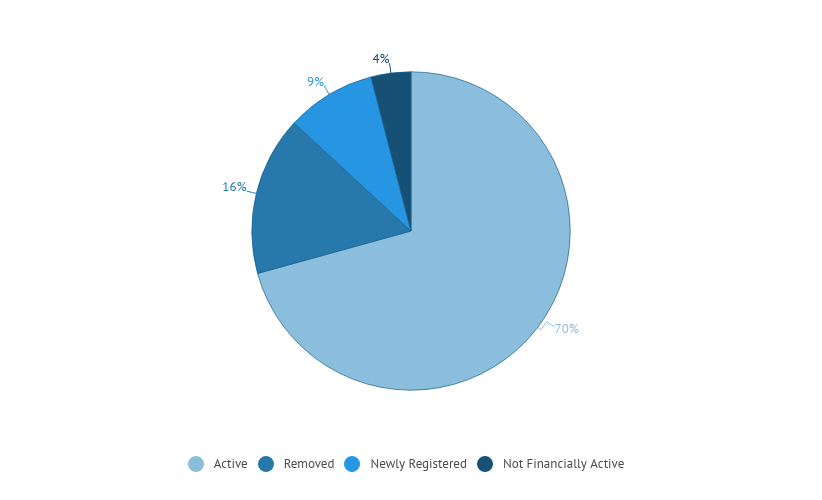

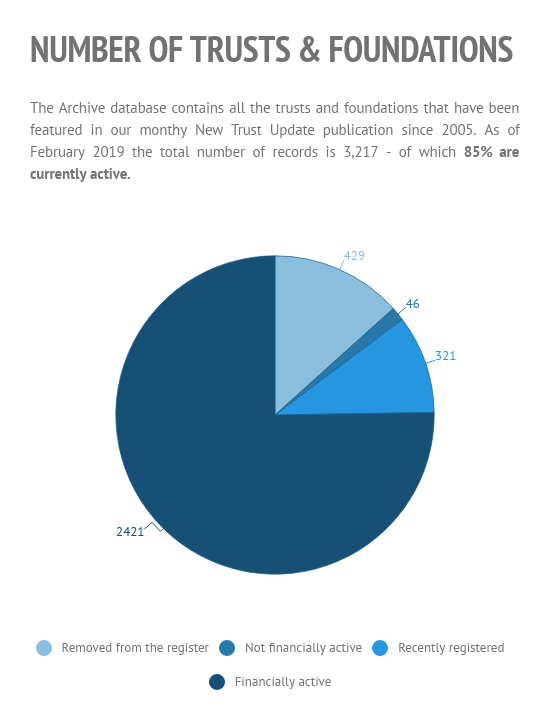

Factary’s New Trust Update (NTU) archive database currently has 3,900 trusts and foundations in it as of February 2022. These are all the grant-makers that have been featured in NTU since 2005.

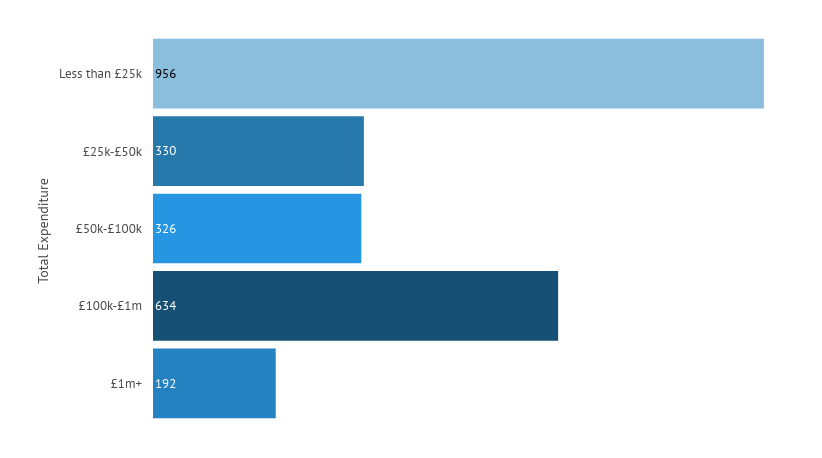

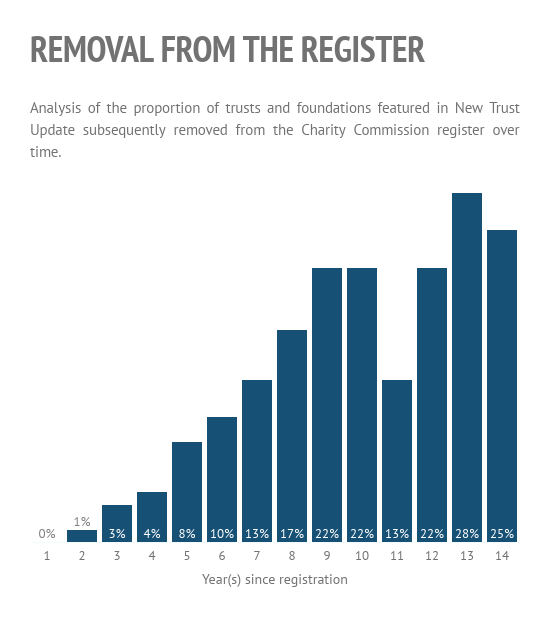

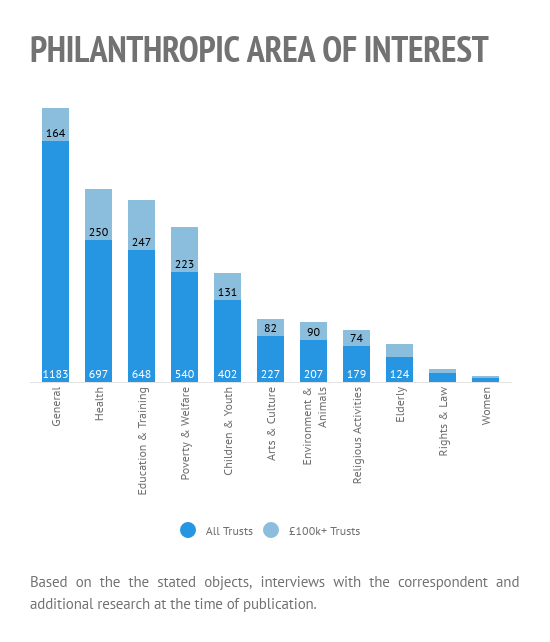

To add value to the database, which is accessible online exclusively to NTU subscribers, we update the records with the latest financial information available from the Charity Commission. We also update the classification information on which trusts have been removed from the Charity Commission register and which are financially inactive. This information allows subscribers to quickly and easily see how large the various trusts are, and therefore which ones are likely to be able to make the largest grants. The database also includes classification information on the potential areas of interest of the grant-makers.

Analysing this data, we can provide a useful overview of the grant-makers in the database and provide some interesting insights into the UK trust and foundation market. We have produced a short report detailing this analysis which can be downloaded here. The highlights are:

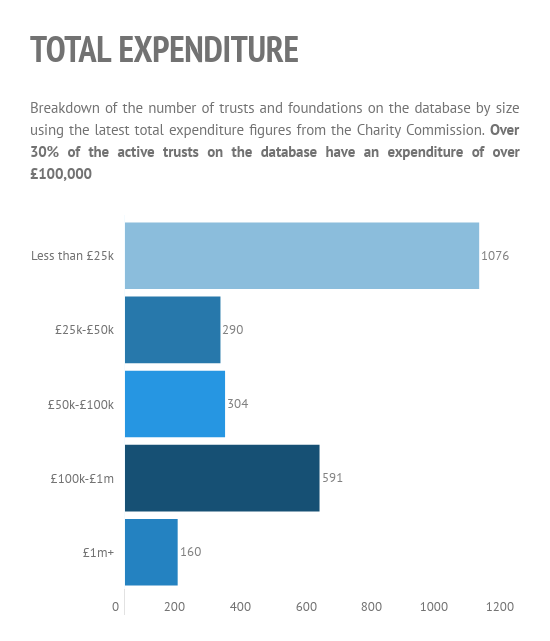

- The database contains details of over 2,500 active grant-makers, giving away over £1.7bn a year

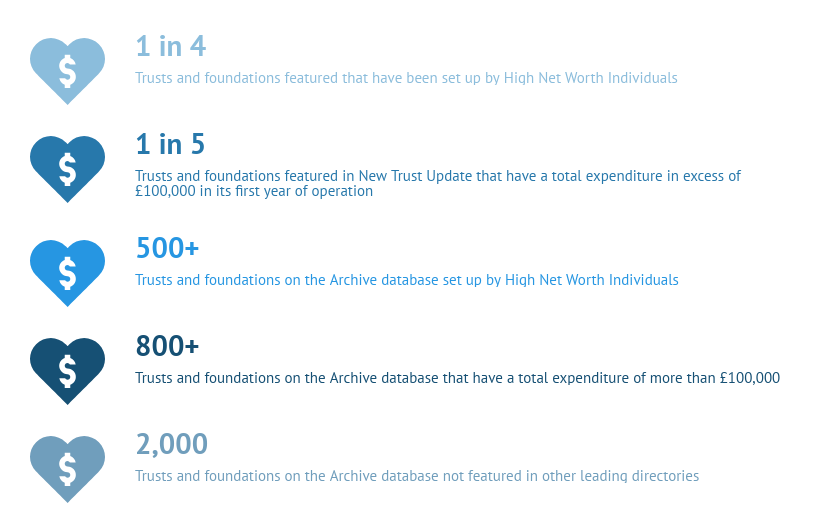

- Over 1 in 3 active funders on the database had a total expenditure in excess of £100,000 in the last financial year

- Nearly 1 in 4 newly registered grant-makers is founded by a philanthropist with an estimated wealth in excess of £10m

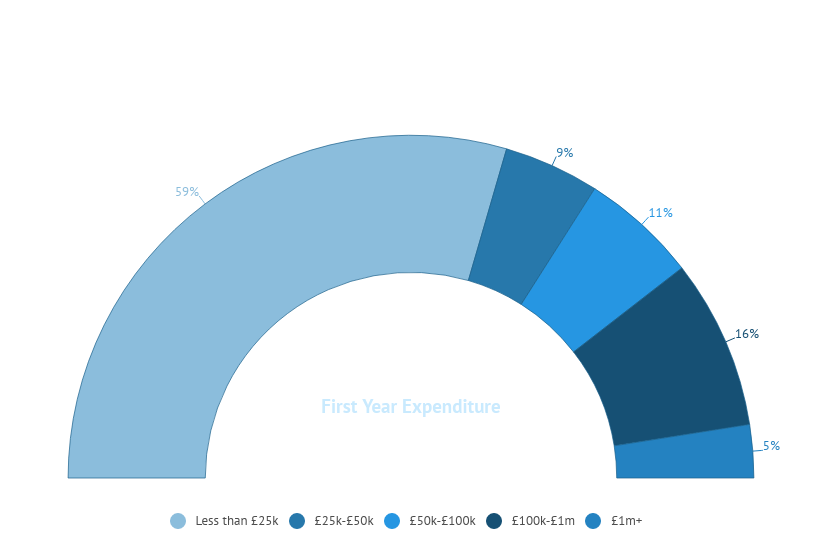

- 1 in 4 featured grant-makers has an expenditure in excess of £100,000 in its first year of operation

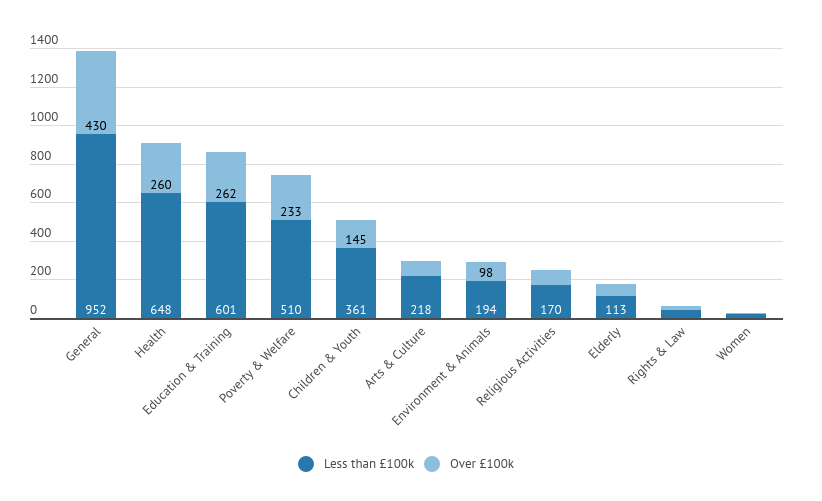

In 2021 there were 228 new grant-makers featured in NTU. 43 per cent of them had general charitable objects, but the next most commonly supported areas were Poverty & Welfare, Education & Training and Health. 2021 saw 31 new Foundations of Wealth grant-makers founded by wealthy philanthropists, with a combined estimated wealth of over £11.7bn. There were also 36 corporate foundations featured in NTU in 2021.

As is shown in the report, over a quarter of newly-registered grant-makers go on to have an expenditure in excess of £100,000 in their first year of operation. This makes NTU a useful tool to find out about these grant-makers as soon as they are registered, and gives subscribers a head start in building relationships with new philanthropists.

You can see further analysis on the grant-makers featured in New Trust Update and that make up the online archive database by downloading a copy of the report.

If you would like to learn more about Factary’s New Trust Update then please contact Will Whitefield: will@factary.com.