Welcome to the January 2014 issue of the Factary Phi Newsletter.

Major Giving News

London Institute to receive £1m gift

A Saudi businessman has promised to donate £1m towards the relocation of the University of London’s Middle East Institute to a historic building in Bloomsbury.

This donation is one of several contributions made by Sheikh Mohamed Bin Issa Al Jaber, a philanthropist and founder of MBI Group, a conglomerate with interests in the finance, food and oil and gas industries that has assets worth more than £5 billion.

Speaking on his donation Sheikh Al Jaber said: ‘When I started the foundation, it was to give talented Scholars from the Arab world freedom of opportunity to shape their own futures, and that of their communities, countries and the region. Education is the catalyst for improved mutual understanding and I am proud to be the founding patron and donor of the LMEI, which has unrivalled intellectual capital and expertise on the Middle East region.’

The Institute has recently examined the results and prospects of the Arab Spring, and the role of the media in social, cultural and political change in the Middle East.

Hull FC owner to donates £1m

The owner of Hull FC, Assem Allam, is set to donate £1m to an appeal set up to help improve the treatments of medical conditions like cancer and heart disease.

The money raised will go towards completing the Daisy Appeal to raise funds for the completion of a new PET-CT Scanning Centre, which is due to open in April.

The latest donation brings Mr Allam’s total contributions to the appeal to £1.6m – but the charity still needs to raise a further £2m to buy a cyclotron and radio-lab facilities that will complement the PET-CT scanner.

The charity’s founder, Prof Nick Stafford, said: ‘This latest contribution is incredibly generous and means we can deliver the scanning centre on time, which is great news for local people.’

‘Currently, this region is served by a mobile scanner which visits just twice a week so to have a permanent and truly world-class facility at Castle Hill will, I believe, have a hugely positive effect on the health of the region.’

Anonymous donor gifts hospice £1m

A hospice in High Wycombe has received a staggering £1m donation towards the re-development of its facilities.

South Bucks Hospice, which provides care for people with cancer and other life-limiting illnesses, will benefit from a planned state-of-the-art redevelopment, with a completion date for the development set at winter 2016.

As a result of the legacy, the charity will also be able to keep its current building, which was due to be sold to help with fundraising costs. The donation was awarded as the executors of the benefactor’s will were impressed with the vision for the new hospice and the passion shown by new chief executive, Jo Woolf.

Speaking on the legacy, she said: ‘We are not afraid to embrace the true existential aspect of patient and family needs.’

‘We’ve moved away from the assumption that dying can be slotted into a standard care plan. Dying is a profoundly complex personal journey that each individual approaches in their own unique way.’

‘The way and where we die is incredibly important. Research shows that 70 per cent of people want to die at home and we believe we are laying the foundations for the future of hospice care in South Buckinghamshire’

Report: Making It Count

This month, we’ve included our summary of a recent report on financial management in small charities, appropriately entitled ‘Making It Count’. The report was sponsored by Lloyds TSB, and was conducted by the Charities Finance Group and the Small Charities Commission.

Introduction

Charities, almost by their nature, are not often set up with financial management as a key priority, at least not to same extent as other, more commercially minded organisations. This is because instead of pursuing profit, they are typically set up in response to a social need, and as such, managing areas such as finance, IT, communications and many other areas of administration will understandably be considered secondary to the charity’s often highly specialised work.

Similarly, those people who sit on a charity’s trustee board are often there chiefly because they believe in its overarching mission and objectives, and not necessarily because they are financially literate. This report seeks to highlight the fact that in spite of this, carefully considered financial management must become a key consideration for all charities large and small, as a carefully considered approach to finance can also play a key role in determining the actions, impact and sustainability of the charity as time goes on.

Context and aims of the report

This report emphasises that strong financial management is not only an important part of legal governance requirements, but is also considered vital in the current economic environment in order to attract funds, which is in turn an essential part of maximising a charity’s impact. Indeed, in a time when charity income and demand for services is higher than ever before, it can be argued that assured financial management has become essential in order to adapt and survive in an increasingly uncertain environment.

The report is intended to provoke a discussion that will stimulate new enthusiasm for achieving progress in this area, and it is also intended to support small charities in improving their financial management.

Methodology

This report has been informed by the following research:

- A literature review of existing work that considers financial capability and skills in small charities.

- An online survey of 323 small charities carried between November 2012 and January 2013.

- Telephone and face to face Interviews conducted with 24 experts from the sector, and particularly, with those who have knowledge of financial management issues, including accountants, funders, local support organisations, national umbrella bodies, and the Charity Commission.

- Interviews with staff and trustees of 19 small charities, mainly those responsible for financial management. 15 of these 19 organisations had an annual income of between £50k and £500k

What constitutes a ‘small charity’

Although there are a variety of different ways to identify and categorise ‘Small Charities’, annual income is considered by the report to be the most reliable way of determining a charity’s overall size, and furthermore, this criteria is also used by the Charity Commission to determine the reporting regulations with which charities must comply. With this in mind, small charities are defined in the report as those with an income of less than £1m.

In terms of financial management, what are the key challenges facing small charities?

- Small doesn’t necessarily mean simple – It is important to remember that small charities, regardless of their size, frequently encounter highly complex issues such as trading subsidiaries, VAT regulations and contract management disputes that should be carefully considered.

- An inability to afford staff with strong financial expertise – Due to their size, many small charities are simply unable to afford someone with finance as their primary responsibility. Instead, such organisations typically rely on the valuable efforts of their trustees and employees who will also have a number of other responsibilities in place of a dedicated specialist.

- A lack of financial capability among trustees – In the case of many small charities, all financial management can be left solely to its treasurer, who may themselves be lacking in confidence and experience, or conversely may be excellent at managing the charity’s finances. The point is made that the competency and skill level of voluntary treasurers can vary hugely, and thus, may have a significant effect on an organisation in terms of its finances, for better or for worse.

- Difficulties locating appropriate information and support – Utilising appropriate training can often be difficult for smaller organisations due to the costs and time constraints typically involved. Although online resources offer much in terms of increasing skills, it can be difficult for some organisations to find definitive guidance.

- Differences between charity and other sector financial management – According to the report, the areas of most difficulty for many small charities tend to be those that are specific to sector, such as restricted funds and the VAT exemptions that are associated with the sector. In dealing with these issues, many organisations will typically rely heavily on staff, trustees and advisers with financial expertise from other sectors, who may themselves struggle to adapt their own knowledge in a charity context.

How small charities can improve their financial management

- Improve financial capability among trustees – Although treasurers play an extremely important role in improving financial capability and the overall decision making process in their organisation, this could be improved upon further with increased collaboration between treasurer and board in order make improvements.

- Seek support from independent examiners and accountants – Their expertise can play a vital role in improving the standards of financial management in small charities.

- Utilise CVS’s (community voluntary service) and community accountancy services – These organisations can provide valuable support and advice in this area. However, the point is made that their level of involvement will depend heavily on geographical location and furthermore, resources from these organisations are already stretched due to continuing funding cuts.

- Outsource financial management – Outsourcing the financial management of a charity can be very cost effective in some circumstances. However, trustees and charity staff can potentially still face the challenge of interpreting and effectively utilising the information provided.

- Gain support from peers and through collaboration – Collaboration between similar organisations and learning from peers can be a highly effective way for small charities to improve their financial capabilities. However, finding a suitable match can also be time consuming.

Conclusion and final thoughts

In an increasingly uncertain economic environment the importance of sound financial management cannot be underestimated, as the correct approach can potentially ensure legal compliance, an ability to attract funding and, above all, can maximise a charity’s impact and sustainability. Furthermore, a clear understanding of a charity’s financial situation can also raise awareness of the potential threats it may be facing, financial or otherwise, and may allow it to better adapt to a change in environment.

The point has been made that many small organisations also face many of the same financial issues as their larger counterparts. However, it is important to note that smaller charities in this position are often unable to afford the qualified staff that specialise in dealing with these problems, and as a result, they can struggle without support. These difficulties can then be exacerbated by an inability to afford training courses, and other appropriate resources. Therefore, is not enough for small charities to simply survive in these circumstances by carrying on as they have before, especially in the face of such pressure to find funding from alternative income streams.

In the face of this, it has become more important than ever to provide trustees and staff with the correct training, tools and guidance that will enable them to fully utilise all resources available to them.

Clickhere for a full version of the report.

Phi in Numbers January 2014

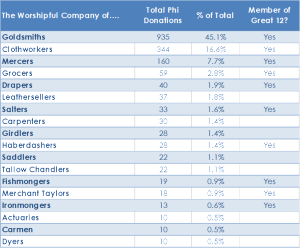

The City of London’s Livery Companies have a strong philanthropic history but can be easy to overlook as a potential source of donations. Phi suggests that the majority of companies are philanthropically active although the extent of their activity varies widely.

The most prolific livery company linked donations on Phi are, unsurprisingly, biased towards the wealthiest – collectively known as the Great Twelve, although others such as the Leathersellers, Carpenters and Girdlers appear to be somewhat over-performing.

If you, like me, wonder what the Worshipful Company of Carmen are all about – they have nothing to do with an opera by Bizet but are, in fact just plain old Car Men or Carters – how very disappointing!

Of the more modern professions, the Actuaries are relatively well represented whereas others such as the International Bankers (with only five donations currently recorded on Phi) could, perhaps, have the potential to move further up the list in the future.

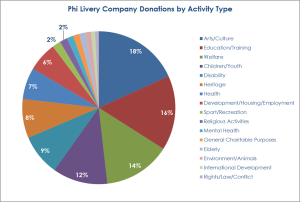

Although the livery company’s history is one of supporting education and welfare related causes, Phi suggests that the arts and heritage are also relatively likely to attract donations. Amongst the top three companies represented on Phi, the most popular sectors to support are Welfare (for the Goldsmiths), Disability (for the Clothworkers) and the Arts (for the Mercers).

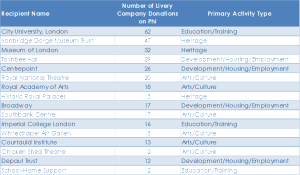

Phi also suggests that a number of individual organisations have been particularly successful at attracting donations from livery companies – with City University having recorded donations from no fewer than 38 separate trades.

The performance of Ironbridge Gorge Museum also stands out – particularly given its location in Shropshire. Whilst major London institutions are clearly favoured, Phi does also show livery company donations going to organisations in Scotland, Northern Ireland, Wales and many parts of England, including regions outside the South East implying that many are open to applications from outside the capital.

Profile: The Rufford Foundation

Founded in 2003, The Rufford Foundation was created as the result of a merger between two family owned foundations with similar aims. These were, the Maurice Laing Foundation, founded by Sir Morris Laing, and the original Rufford Foundation founded by his son, John Hedley Laing.

Born in 1918, Sir (John) Maurice Laing was a senior executive of John Laing plc, a family owned construction business specialising in public sector and infrastructure related projects. He initially began working for his father during his school holidays, before eventually joining the firm full time in 1935 at the age of 17.

After starting his career a trainee, he soon rose to managing the construction of new airfields and barrage balloon stations by the year 1938. However at the outbreak of the Second World War, he chose to leave this position in order to serve in the RAF, against his father’s wishes. He initially served in the ranks, but rose to the position of Flying Officer before eventually re-joining his father’s construction business at the conclusion of the Second World War in 1945.

His stock continued to rise in John Laing plc, and he was promoted to the management structure of the firm, and supported his brother Kirby Laing as Chairman. Their father retired in 1957, and Maurice would later swap positions with his brother, becoming Chairman of the Laing Group.

Under his leadership, the company’s property and constructions divisions were notably split into two separate companies, however Laing Properties was eventually floated in 1978. Maurice continued to serve in this position until his retirement in 1982, and he was also made the group’s life president upon his retirement.

His son, John Hedley Lang ran the Rufford Foundation until it was merged with the Maurice Laing Foundation 2003. He remains a Trustee, and according to the aims listed on its official page, the foundation supports nature conservation projects by making grants to small or medium-sized organisations in developing countries.

For the financial year ending the 05th April 2013, the trust reported an income of £68,983,707 and an expenditure of £2,216,097. Factary Phi holds 1,021 records made to various organisations since 2005, and these are worth a minimum of £18m.

From these, the highest single donation was made to the Rufford Small Grants for Nature Conservation for £890,959 and according to Phi, the largest number of donations have typically been made to causes associated with Environment (173) followed by International Development (109), Children/Youth (101), Disability (100), Health (92), Education (91), Welfare (80), Animals (55), Religious Activities (32), Sports/Recreation (31), Development/Housing/Unemployment (42), Arts/Culture (25), General Charitable Purposes (19), Elderly (18), Rights/Law/Conflict (16).

The Trustees

Robert Reilly

Robert Reilly is a Partner with Harbottle & Lewis LLP where he specialises in capital projects, developments and commercial property matters. He is also a Trustee of the New Orange Tree Theatre Trust and the Rufford Small Grants Foundation.

John Laing

John Laing, the son of Maurice, established the Rufford Foundation and he was also a founding trustee of the Whitley Fund for Nature. Although no longer involved in the family construction business, the Laing family are ranked on the Sunday Times Rich List with an estimated wealth of £119m.

(Elizabeth) Sarah Brunwin

Sarah Brunwin is a Directorate Consultant for the WWF and she also heads her own fundraising consultancy, Sarah Brunwin Consultancy Services.