Welcome to the March 2016 issue of the Factary Phi Newsletter.

The New Trust Update Archive and our Major Giving News

New Trust Update Archive

Before we continue with the newsletter, we just wanted to take this opportunity to mention a new service that Factary has recently launched – our ‘New Trust Update Archive’. We believe it will be of particular interest for those of you using Phi for researching Trusts & Foundations.

Factary produces the ‘New Trust Update’ each month, it is a publication containing detailed research and interviews with new grant-makers that have been set up at the Charity Commission. The publication usually contains details of around 20 new potential grant-makers. The New Trust Update gives subscribers the chance to build relationships with these grant makers before they are included in other resources and swamped with applications. Reviews of past issues indicate that at least 10% of new registrations are now major donors with current grants approaching £1 million.

Last month we launched the New Trust Update Archive service – an online, searchable database of 10 years’ worth of past editions. With a subscription, you can review all the 2,500 trusts which have appeared in past editions since 2005, and search them by their areas of interests, keywords and trustee name.

We’ve had excellent feedback so far from subscribers – with one calling it ‘A great new tool in prospecting’. Please visit http://factary.com/what-we-do/new-trust-update/ to find out more or email Nicola Williams, Research Director, nicolaw@factary.com

Pharma couple donate £1m

Dr Vijay and Smita Patel have made a £1m donation in support of De Montfort University Leicester.

Vijay Patel is the Chief Executive Officer of Waymade Healthcare who also graduated from DMU’s Leicester School of Pharmacy, alongside his wife Smita.

Speaking on their donation Dr Patel expressed his desire to give something back, and said that: ‘Education and the university experience is the bedrock for what we have achieved and we want to be able to help make sure as many people as possible have the chance to experience this.’ Their donation is considered to be largest individual gift to have been made in the institution’s history.

Christian Heritage Centre at Stonyhurst College to receive £2m

Thanks to a generous donation from the Theodore Trust, the Christian Heritage Centre has received a gift that will contribute to a new retreat, study and leadership centre.

This is to be its final donation before the trust begins the process of winding up its activities. It was founded in order to make donations to churches, charities, libraries and schools. It takes its name from St Theodore of Canterbury, who was a Syrian Christian who was appointed as Archbishop of Canterbury by the pope in 668.

Lord Deben, who is a Trustee, said the donation was ‘an appropriate legacy for the trust’ adding that ‘we are happy to support such a worthwhile endeavour. We are delighted that the retreat, study, and leadership centre is to be named after St Theodore of Canterbury. Knowledge of their rich story will help Catholics to be more insistent about their place in British society and the Christian Heritage Centre will also celebrate the importance of artefacts and transmit the love of our faith to the next generation’.

Report: Ten Year Perspective

This month we have included our summary of Knight Frank’s Ten Year Perspective, which is taken from its Report Attitudes Survey as part of the company’s World Wealth Report 2016.

In particular, this section of the report is intended to provide some insight into how the outlook of the world’s wealthiest people has changed over the past ten years. The findings of the survey are based on the views of around 400 of the world’s private bankers and wealth advisors, who between them manage the assets of around 45,000 ultra-high-net-worth individuals (UHNWIs).

According to this year’s survey, one of its most interesting outcomes is that a significant proportion of the respondents (leading wealth managers, private bankers etc) expected that their clients’ wealth would increase at a slower rate over the next 10 years than in the past decade.

The survey also considered attitudes to both philanthropy and property, both of which remained high on the UHNWI agenda.

Wealth Issues

The first ever wealth report to have been launched by Knight Frank was made public in the year 2007, just short of the beginning of the global financial crisis. This is significant in that it is largely because of this event that it seemed (at the time) that subsequent editions would be almost entirely focused on a reduction of new wealth rather than its creation. Based on the report’s analysis of global wealth distribution over the subsequent ten years, however, UHNWI numbers have only increased around the world, particularly in newer emerging markets.

With that said, the forecast for the next ten years is notably more cautious, the report states, with the rate of wealth creation among UHNWI’s predicted to slow by a considerable margin. This attitude is also reflected in the report’s Attitudes Survey, in which, two thirds of respondents agreed that their clients’ wealth had increased at a faster rate over the past ten years than it would during the next ten years.

In Australasia, 84% of respondents predicted a slowdown which is perhaps understandable given that much of the wealth creation in this region has been powered by China’s economic growth, which is now beginning to slow.

In global terms the issues of succession, inheritance, wealth taxes and the global economy were identified as the four main factors threatening wealth creation over the past years and in the next decade.

Elsewhere at a regional level, personal security and safety were cited as a high priority for Latin America, with 63% of respondents citing this as a growing concern over the past ten years. Looking forward, personal and family health was the third most important issue for North American UHNWI’s.

70% of respondents stated that their clients had become more conscious about displaying their wealth in public. A significant number also felt that UHNWI’s were being scapegoated by governments for their failure to address wealth inequality issues.

Management Matters

There were also a number of interesting trends when it came to how UHNWI’s choose to manage their wealth. Not only did 87% of those polled state that their clients are taking a more active role in managing their wealth, but 92% also agreed that the wealth industry had to work harder to earn the trust of their clientèle.

80% said women were taking a more significant role in managing family wealth, while 64% stated that their client’s children were becoming more involved in their business interests at an earlier age.

As was also mentioned earlier in the report, succession issues were identified as the biggest concern of all, with recent research suggesting that it is the second generation, rather than the oft-quoted third who are the most likely to squander the family fortune.

When asked why their clients were so concerned about handing their wealth to the next generation, 62% said they didn’t feel their children would be encouraged to make their own wealth, while almost half said they wouldn’t know how to handle the investments.

Based on this, it appears that encouraging them to get involved in the family business from a younger age would be an obvious solution. Unfortunately however, as many as two thirds are generally not inspired to join the family business, preferring instead to pursue their own separate professional or entrepreneurial ambitions.

Philanthropy

While protecting their wealth would be considered an obvious priority and perhaps even a preoccupation for many UHNWI’s, giving it away was also cited as important for many.

On average 67% of the respondents who took part in the Attitudes Survey said that their client’s philanthropic activities had increased over the past 10 years, with almost 80% expecting their philanthropic activities to increase further over the next 10.

In terms of their motivations, personal fulfilment was cited as a major factor for many, although in the Middle East religious beliefs were considered to be almost as important.

According to the survey that the way in which the wealthy are choosing to give is changing, as is evidenced by the Zuckerbergs for example, who created a more flexible limited liability company in order to oversee their endeavours.

Tom Hall, who is Head of Philanthropy Services at HSBC said: ‘Not only is philanthropy increasing, so too is the desire to ensure that it is truly effective and actually solving the social and environmental problems of our time.’

‘Philanthropists are becoming increasingly sophisticated in how they structure their giving and investing, with social impact emerging as a key third dimension along with risk and return in every investment decision.’

Property

According to the responses, residential real estate accounted for a quarter of the average UHNWI’s investable wealth, while commercial property investments made up 11%. Over the previous 10 years, 54% of the respondents stated that their clients had increased the allocation of their wealth into residential property.

Just over 40% expected this to increase even further over the next 10 years, stating that 30% of their clients were likely to consider a residential purchase in 2016. When asked about the reasoning for this, the most popular reason for the purchase (55%) was that so it could be used as an investment to be sold on in the future. Investment diversification and a means of providing a safe haven for funds also scored highly, and aforementioned ‘safe havens’ were considered to be especially important for respondents with clients based in Russia and the Commonwealth of Independent States.

Interest in commercial property has also grown strongly, with 47% of wealth advisors predicting an increase of portfolio allocation in this area by their clients over the next 10 years.

Offices and hotels were predicted to remain as investment of choice in this area, however investments in warehousing and logistics could also overtake shopping centres and high-street retail, according to the responses. A lack of experience was cited as the main reason for the relative lack of private investment into this sector.

Click here for a full version of the report.

Phi in Numbers: March 2016

During the course of this month, a whopping 32,157 new records of donations have been uploaded onto the Phi database worth in excess of £148m.

This brings us to a total of 664,859 records of donations in Phi overall, with the latest upload containing donations made to a variety of UK universities and charities. Some examples of these include World Vision UK, Norwood, Motability, Marie Curie Cancer Care and The Royal National Theatre amongst others.

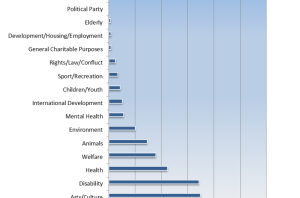

For this month’s edition of our Database Update, we thought it might be interesting to survey the latest charities data to have been uploaded onto the database, which consists of over 10,000 new records alone. We have included a breakdown of these donations according to their activity type, featured below.

As the chart above demonstrates, the Education/Training and the Arts/Culture activity types are the most widely represented, with 2,650 and 1,744 records of donations respectively.

The largest single donation to have been included this month comes in the form of a £25,000,000 grant, made by the Big Lottery Fund in support of the alcohol and drugs charity Addaction. Whilst there are relatively few donations in this activity type, thanks to this very large single donation, the Animals activity type also comes in first in terms of the activity type with the greatest average size of donations.

With this excluded, the Health category comes in first with an average donation size of £740,204, followed by Rights/Law/Conflict (£222,706) and the Children/Youth activity type (£194,634).

Profile: The Souter Charitable Trust

The trust was formed in 1992 by the Scottish businessman and philanthropist Brian Souter, an original founder and Chairman of the Stagecoach Group who is featured on the Sunday Times Rich List with an estimated wealth of over £1 billion.

The son of a bus driver, he was born in the town of Perth in 1992 where at school he showed an early interest in economics and accountancy. He attended Abertay University where he originally trained to become a commerce teacher, before then studying accounting and economics at Strathclyde University in Glasgow. Following on from this, he got his first job as a chartered accountant with the firm Arthur Andersen & Co.

It was in 1980, with the help of his sister Ann and brother-in-law Robin that Brian established The Stagecoach Group. The company began by running buses from Dundee to London, and the venture was initially funded by Brian’s father, who had recently been made redundant from his job as a bus driver.

Stagecoach expanded rapidly and by the early 1990’s, it had acquired National Bus Company subsidiaries in Cumberland and Hampshire, the East Midlands, Ribble, Southdown and a number of others assets based in Scotland, Newcastle and London. Soon after this, Stagecoach had also developed interests in Australia and New Zealand.

It was around this time in 1992 that he and his wife Betty established the Souter Charitable Trust, which is listed a supporter of projects which are for the relief of human suffering in the UK and overseas, with a preference for those which promote spiritual welfare, or that have a Christian emphasis. Brian is also a member of the Trinity Church of the Nazarene in Perth.

For the financial year ending the 30th June 2015 the trust reported an income of £6,535,112 and an expenditure of £10,267,307, Factary Phi holds 101 records of donations made to various organisations since 2006. According to Phi, the largest proportion of these donations have been made to causes associated with Welfare (144),

The Trustees

Betty Allen

Betty Allen is also a member of the Church of Nazarene.

Ann Allen

Ann Allen is a Christian activist and a former convener of the Board of Social Responsibility of the Church of Scotland.