Welcome to the January 2013 edition of the Factary Phi newsletter.

Major Giving News

Government to donate £35m in banking fines to armed forces charities

The government has pledged in its mid-term review to donate a whopping £35m raised from bank fines to armed forces charities.

The document launched on the 7th of January by the Prime Minister, David Cameron, and the Deputy Prime Minister, Nick Clegg, also reaffirms plans on payroll giving and Gift Aid. The charities will receive money from fines levied by the Financial Services Authority, including those for manipulating the Libor rate, which governs the interest rate of a number of different financial products.

The review also dedicates one-page to the Big Society and social action and details the government’s plans in this area. More specifically, it says a payroll giving consultation, first announced in September, will be published shortly; and that more match-funding will be made available by government. A number of previously-announced initiatives are also listed including the training of 5,000 community organisers and the introduction of online filing for gift aid claims.

Factary Phi records Sir Terence and Lady Conran’s support of the Museum of London as well as entries in the Sunday Times Giving List 2010 and 2011.

Ahead of the mid-term report however, Acevo chief executive Stephen Bubb has issued a statement criticising the government’s level of commitment to the charity sector, commenting that the term Big Society “is effectively dead”.

He went on to say that “The reality many charities now face is crippling spending cuts: half of local councils admit making disproportionate cuts to charities in spite of government guidance to the contrary. Most Acevo members whose funding is being cut have had to respond by reducing the services they provide”.

Farming charities to receive much needed boost

Four charities will receive a combined donation of £300,000 from The Princes Trust and the Duke of Westminster in order to help farmers cope with the effects of last year’s disastrous weather conditions.

The money will help farmers struggling financially following last winter’s drought and wet summer which has led to a shortage of grazing land, low stocks of fodder and a poor harvest, compounded by the rising cost of feed and fuel.

During a meeting at Clarence House, Prince Charles said: “I have been growing increasingly concerned about the many difficulties which farmers from all sectors are facing – and are likely to face – this winter and so I thought it was important for us to come together, hear what we each have to report and then I want to see what I can do to help through my Prince’s Countryside Fund. When I set up my Countryside Fund, I and the trustees decided from the start that we would always keep a lump sum available to be used for any farming emergency. I think we are all agreed that many British farmers are facing an emergency situation.”

The four charities involved are the Farm Crisis Network, the Royal Agricultural Benevolent Institution, the Addington Fund, which provides housing for farming families, and the Royal Scottish Agricultural Benevolent Institution.

“These donations from Prince Charles and the Duke are marvellous news,” added Mr Clarke. “There are so many problems facing the industry at present and the increase in the number of cases and their complexity is very considerable.”

Sporting charity nets £50,000 donation

Panathlon Challenge has welcomed a £50,000 donation made by the Stanstead Community Fund.

The Essex-based charity works with schools across the county and organises sporting competitions, offers free training courses, supplies specialist equipment and provides qualified coaching and expertise for disabled youngsters.

Members from the Stansted Community Fund together with special guests Priti Patel MP and Paralympians Anne Wafula Strike, Louise Sugden and Richard Chiassaro, presented a cheque to Panathlon Challenge at Witham’s Southview School on January 18th.

Speaking at the event, Ms Patel said: “I welcome the commitment made by the Stansted Community Fund to support Panathon Challenge in Essex. This charity does tremendous work supporting disabled children through giving them new skills and opportunities to fulfil their potential.

“Following the success of the Paralympic Games this generous contribution will go a long way to helping to get more disabled children enjoying the benefits of playing sports.”

The Stansted Community Fund’s judging panel, which included representatives from the community, studied a wide range of bids before choosing the Panathlon as the winner. The successful project needed to demonstrate a link to education, the environment or employment and bring a lasting benefit for many people in the communities surrounding the airport.

Panathlon Challenge founder Ashley Iceton was delighted with the donation.

“This is fantastic news for Panathlon to have the support of Stansted Airport in 2013, which follows on from their support of our charity last year.

“The £50,000 donation will ensure Panathlon thrives in Essex and will go to support hundreds of disabled children through specialist equipment supply and creating Paralympic type sports events throughout the county,” he said.

Reading Graduates donate £200,000

Former alumni of the University of Reading have donated more than £200,000 to support future students through its Annual Fund telephone campaign.

A team of 50 students from the University spent five weeks manning phone lines and urging alumni from the past 60 years to pledge a cash gift and share their thoughts on their time at Reading.

Nearly 500 of those spoken to also chose to make a donation to the Annual Fund, which will support a range of projects that have helped place Reading in the top one per cent of universities worldwide.

Barbara Bray, who graduated with a BSc in food technology in 1995, said: “I chose to make a donation to the Annual Fund because of the direct support it gives students who would otherwise struggle to afford a university degree.

“I really value the experience I had at Reading and during my career I have seen how Reading graduates stand out from the crowd.

“The conversations I have had with the student fundraisers have always been entertaining and brought back good memories of the time I spent at university and have given me the opportunity to offer advice and encouragement.”

The University of Reading’s Annual Fund was established in 2004 and to date in excess of £3.4 million has been raised from more than 6,000 donors, which has funded more than 100 projects.

Next section: ReportReport: A Synthesis of the Current Research Into Major Donors and Philanthropic Giving

The report was commissioned by the Institute Of Fundraising and conducted by Sarah Lincoln and Joe Saxton of nfpSynergy.

Researching Major Donor Giving

In the US, any individual who makes a suitably large donation to charitable organisations can generally be considered a ‘Major Donor’. However whether or not the gift is large enough to qualify them as a major donor to an organisation does depend on the organisation they support, its size, income, and the type of donations it typically receives.

Along with issues over definitions, it is also difficult to conduct precise research in the extent and nature of philanthropy from major donors due the voluntary nature of their acts. Because of this and other limitations in research, major donors can often be somewhat difficult to research, as questions around personal income, wealth and the proportion of it given to charities can also be potentially sensitive for major donors, leading to the potential for bias in both responses given and those electing to participate in research.

Bearing this in mind, any existing research can be of great benefit to charities, as it can provide them with the opportunity to better under the motivations behind major donor giving. This is identified as an area of great potential for charities in the report. It is noted that in the 2011 Coutts Million Pound Donors Report, just 21% of the total value of the 80 donations worth £1 million or more made by individuals in the UK in 2009/10 went to charities rather than to foundations or higher education. This research offers charities the chance to more consistently adopt best practice and so increase the value of major donor giving to their causes.

Reflecting the higher level of philanthropy in the US than anywhere else, the report is also quick to point out that the scale of practice and body of evidence in the US is too significant to ignore in any current synthesis of major donor giving. With this in mind, it is also important to be aware of the various different bodies and organisations that have commissioned and/or conducted the research, and their various aims, priorities and resources in doing so.

These include:

- academic research centres (e.g. the Centre for Charitable Giving and Philanthropy at Kent University, Boston College Center on Wealth and Philanthropy, The Center on Philanthropy at Indiana)

- research think tanks and companies (e.g. ippr, Ipsos Mori)

- government departments (e.g. HM Revenue and Customs)

- the media (e.g. The Sunday Times, Forbes)

- philanthropic advisors and consultants (e.g. Theresa Lloyd)

- banks, financial advisors and wealth management consultancies (e.g. Coutts, Bank of America, Scorpio Partnership, Merrill Lynch)

Comparing US & UK Philanthropy

Since the majority of research conducted on this subject is concerned with US and UK philanthropy, it is also important to consider the differences in philanthropic giving between the two countries. The US has the highest level of giving as a percentage of GDP; at around 2% per annum, followed by the UK where philanthropic giving is less than half this, at around 0.7% of GDP. Wealthy Americans routinely give 3.5% of their investable assets to charity against 0.5-0.8% for their British counterparts.

Theresa Lloyd describes US philanthropy as ‘not just an option which wealth provides but… a defining characteristic of the elite’. Philanthropy in the US is a social institution that takes on meaning in a culture of individualism and private initiative and in the absence of a comprehensive welfare state, especially in health provision. Lloyd also notes that US philanthropy operates in an environment which is resistant to the idea of the state having a very prominent role to play in the provision of welfare and higher education.

Tax regimes in both countries also vary a deal. In the US, donors may reserve capital to be given to charities at a later date, while still receiving income and tax relief from the time the money was allocated to the charity. This is known as “planned giving” and it accounts for a considerable proportion of major gifts received, especially for endowments for cultural and education institutions.

Giving in the US is also considered to be much more of a public affair when compared with the UK. Lloyd’s research in 2004 found a widespread feeling of unhappiness about the status and respect given to philanthropy in the UK, due in part to complex attitudes to money, class and wealth creation in the UK.

Different Forms of Giving

The 2010 Study of High Net Worth Philanthropy found that volunteering time is a significant part of the philanthropic efforts of wealthy individuals. Over three-quarters of those surveyed volunteered in 2009, and those who volunteered more also donated more. The 2000 Wealth with Responsibility Study found that 92% of respondents had volunteered their time to charitable or political causes over the previous three years, and 86% currently volunteered at least one hour per month (often in a leadership role), which was nearly double the national average.

The report also documents the emergence of ‘new philanthropy’ in 21st century that is characterised by a more hands-on approach to philanthropy, donating talent, experience, skills and access to networks as well as their money. Instead of simply donating to existing charities, these new philanthropists instead set up their own projects and foundations, which aim for more results-oriented “investment-like” giving aimed at maximizing societal return on investment.

The term ‘philanthrocapitalism’ has been used to describe this approach to giving by transferring skills and attitudes from the for-profit to the non-profit sector. According to the report, this attitude is exemplified by individuals such as Bill Gates and Warren Buffet. The desire to maximise the impact their money can achieve fits with this trend towards involvement and ‘giving while living’, rather than endowing foundations in perpetuity.

The term ‘venture philanthropy’ is also considered a valid approach to charitable giving. The difference being that this approach uses specialist expertise and financial resources in order to provide a social return instead of a financial one. This form of philanthropy has previously been documented as early as the 1980’s from many longstanding philanthropists, including inheritors of old money and entrepreneurs.

All of these approaches share an emphasis on rigorous assessment of the impact of giving and thus the need for measurable outcomes. Arrillaga-Andreessen argues that good intentions should not be mistaken for impact: ‘to maximize the difference we can make, we need to do more than intend to do good’.

The report highlights the importance of greater access to annual reports, financial statements, and impact evaluations and in addition to this, there is also evidence of a greater role for professional advisors in individuals’ philanthropic decisions. According to the World Wealth Report, the growing desire among donors to ensure that their giving actually makes a difference has led to a demand for the same kind of professional advice in making these types of investments as when making financial investments.

Motivations for Major Donor Giving

The wide variation in giving levels among the wealthy shows that there is no simple relationship between the possession of economic resources and giving. When asked about their motivations for giving, people rarely account for their giving with reference to the size of their income or assets. The capacity to give must be matched by the desire to give.

Various theories of philanthropy have been suggested, summarised briefly here:

- Consumption philanthropy: neo-classical economic model emphasising the ‘purchase’ of donor benefits, e.g. donate to a church one attends or supporting medical research into a disease one might contract. The definition of consumption may also be stretched to include intrinsic benefits, such as the satisfaction and pleasure gained by making a gift, in order to incorporate philanthropy involving neither tangible nor potential benefits, such as support for overseas development.

- Identity-forming: some sociological studies link philanthropy to the rise of individualism and the role that being philanthropic plays in creating and communicating a certain identity.

- Transformative: philanthropic acts can be seen as an effort to shape the world around the donor, whilst also transforming the donor’s self-image and how they hope to be perceived by others.

- Social act: rather than being a simple financial transaction, philanthropy entails a social act, involving relationships between donors, charities, recipients and other donors.

- Pursuit of self-actualisation: theories linking philanthropy to the pursuit of a moral and purposeful life, particularly in richer societies where basic needs are met and people have come to realise that money is a means, not an end, to finding happiness and fulfilment in life.

Most studies agree that all giving is motivated by an array of factors. Whilst some of these may be more likely to motivate those with substantial means, the motives that generate philanthropic giving among the wealthiest are for the most part what prompt people to give across the economic spectrum.

These include: personal affiliation to a charity, faith or upbringing, perceived ‘worthiness’ of the cause, satisfying a ‘social conscience’ and providing a ‘sense of wellbeing’. Thus, Edwards argues that ‘at the crux of [major donors’] giving behaviour exist the same motivations that are true whatever your income’, involving some form of acknowledgement of a responsibility for others and the importance of looking beyond your own needs (for instance, I want to give something back; It’s important to do my bit; I want to support those less fortunate).

Recommendations for Charities

The recommendations below focus specifically on steps that charities seeking to improve their income from major donors can take. A number of actions can be taken to help develop the culture needed in charities seeking to develop long term support from major donors, including:

- Fundraising and the development of relationships with major donors should be seen as Integral to the mission of the organisation

- Securing long term financial security is positioned as complementing the programme activities

- Job descriptions, work plans and person specifications at senior level throughout the organisation take account of the need to give effective time to nurturing relationships with major donors

- The fostering of partnerships with donors is seen as part of trustees’ role (as with senior and specialist staff), with corresponding recruitment and training

- Long term investment in developing relationships and for detailed prospect research is budgeted for, including the identification of the person best placed to introduce the prospect to the work of the charity

- The fundraising department has one “account manager” for each major donor. It is essential to take a personal approach to initiating, building and managing relationships with major donors, and involving and engaging them in the charity’s work

The report also emphasises a more personal approach to initiating, building and managing relationships with major donors, and involving and engaging them in the charity’s work.

- Address the interests of the donor

- Demonstrate a respect for any areas of expertise or skills which are the source of the donors wealth

- Address legitimate concerns about governance and accountability

To view the full version of the report, please visit the NfpSynergy website.

Phi in Numbers: Database Update January 2013

During the course of this month, 12,177 new records of donations have been uploaded to the Phi database, bringing the database to a grand total of 387,000 records.

As these new records are almost entirely made up of donations made to the University of Edinburgh and the University of Dundee from individual donors and university alumni, we have decided to examine donations made to universities from different donor types in a wider sense.

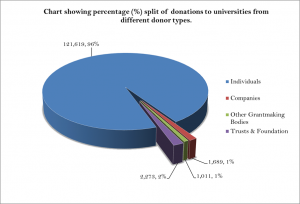

From the latest data to be uploaded, 97% of all donations have come from individual donors, with 3% coming from other donor types. This is also consistent with the number of donations to universities across the entire database, as the pie chart demonstrates below, we can see that overall, the majority of donations made to Universities are largely made up of those from individual donors, with donations from all other donor types accounting for just 4% of recorded donations.

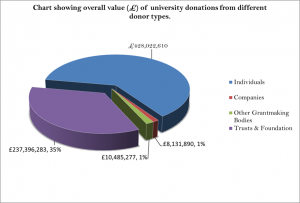

When we examine the overall value of donations to universities from different donor types across Phi, those from companies and other grantmaking bodies also remain consistent, accounting for 2% of all donations.

However in the case of Trusts & Foundations, it is interesting to note that a relatively small number of records account for a much larger (35%) chunk of all donations to universities in terms of value. This is potentially due to Trust & Foundation donations reporting donation amounts more readily than other types of donor.

It should be noted that the data used has been based on records as they appear in Phi, and as such it is not necessarily representative of giving in the sector as a whole.

Profiles: The Dulverton Trust

The Dulverton Trust was established by deed in 1949 by the 1st Lord Dulverton, Gilbert Wills.

The Wills Family played a leading role in the early development of the tobacco industry in the UK and as a result became very wealthy. The business began as a small family partnership and thrived independently throughout the 19th century so that by 1901 it was the biggest and most prosperous tobacco manufacturer in the UK.

In 1786, Henry Overton Wills founded WD and HO Wills and began trading in tobacco shipped from the New World into Bristol. From a modest beginning in a converted house, the Wills’s tobacco empire expanded rapidly throughout Bristol and the rest of Britain. By the late 1890s, the company had factories in Belfast, Newcastle and Glasgow.

The firm continued to grow in strength, eventually amalgamating with a number of other companies to form Imperial Tobacco. The Wills family still held sway over the trade, however, with Sir William Henry Wills, later Lord Winterstoke, becoming the first chairman of Imperial Tobacco.

Today, Gilbert Wills’ grandson, Christopher Wills serves as Chairman of the Dulverton Trust, which supports a wide range of different causes. Broadly speaking, these areas of activity are listed as follows:

Health and counselling for addiction, disability, the arts, sport, animal welfare, expeditions, volunteering, major building projects, endowments, retrospective funding, appeals to replace statutory funding and conferences and cultural festivals.

According to the annual accounts for the trust, £2.7m was distributed in the form of grants during 2011-2012.

Factary Phi records 1345 records of donations made to various organisations since 2005. In terms of the most common activity types to be recorded in Phi, donations to Children/Youth related causes are the most common (276), followed by Welfare (222) and Education (222).

The number of donations to other causes are divided up as follows: Development/Housing (113), Environment(86), Religious Activities (80), International Development (65), Heritage(50), General Charitable Purposes (42), Health (42), Rights/Law/Conflict (36), Sport (33), Animals (32), Disability (28) Arts/Culture (25), Elderly (21).

The largest single donation recorded in Phi was a grant of £1,000,000 made to the Farmington Trust in 2006. Over the period of 2005 to 2010, the average size of grants made to charitable organisations is £11,807.

The Trustees

Sir John Kemp Welch

Sir John Kemp Welch was knighted in 1999 for his services to financial regulation and he has over twenty years of investment management experience with early stage technology companies. From 1987 to 1997, he held progressively senior investment management positions at Innovation Ontario Corporation; a venture capital firm involved in early stage technology investments. Prior to this, he was an investment manager with the Ontario Energy Corporation, which invested in a variety of energy-related technology and oil and gas companies. He is also a former Chairman of the Stock Exchange and the King’s Medical Research Trust, and he is currently a Trustee of the Farmington Trust Ltd and The Kemp Welch Charitable Trust.

Christopher Wills

Christopher Wills is Chairman of the Trust and he is also a Trustee of the Hampshire Housing Trust.

The Lord Gilbert Michael Dulverton

The Lord Gilbert Michael Dulverton is a Trustee of The Help in Need Charity and he is also Chairman of Thwaites Ltd, a Director of West Highland Woodlands Ltd and of Batsford Estate Co.

Dame Mary Richardson

Dame Mary Richardson is a trustee of The Foundation for Circulatory Health, The Magna Carta Trust, The Marine Society and Sea Cadets, and she is also former Chief Executive of the HSBC Education Trust.

Richard Andrew Fitzalan Howard

Richard Andrew Fitzalan Howard is an Asset Allocator and the son of Major General Lord Michael Fitzalan-Howard. Mr Howard is a Director of FF & P Asset Management Ltd, CCLA Investment Management Ltd and he is also a Trustee of the Order of St John Care Trust.

Sir Malcom Rifkind

Sir Malcom Rifkind is Conservative Party politician and Member of Parliament for Kensington. He has served in various roles as a cabinet minister under Prime Ministers Margaret Thatcher and John Major, including Secretary of State for Scotland, Defence Secretary and Foreign Secretary.