Welcome to the December 2012 issue of the Factary Phi Newsletter.

This month, as you’ve no doubt noticed, we’ve moved the newsletter online. We’ll also be adding back issues of the newsletter to our website in the coming months, so that you have access to the entire back catalogue at all times.

Phi in Numbers

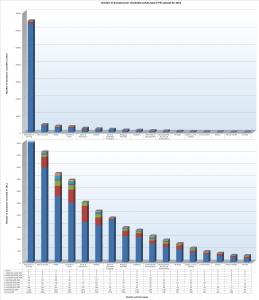

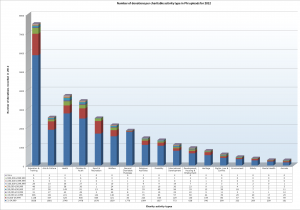

In this month’s analysis, we’ve looked back over the last year to analyse the number of donations recorded in 2012, by charitable activity type.

Major Giving News

‘Will.i.am’ supports UK’s disadvantaged youth with £500,000 donation to Prince’s Trust

Following a meeting with the Prince of Wales, the musician and philanthropist Will.i.am has decided to make the substantial donation to fund education, training and enterprise schemes for disadvantaged young people in the UK.

The Black Eyed Peas frontman planned to make the donation via his i.am angel foundation after meeting youngsters on a Prince’s Trust personal development course in East London last month.

will.i.am is an inspiring character – we’re excited about his vision of helping the most disadvantaged to improve their computer skills and we’re incredibly grateful for the donation.

Speaking on the donation, he said that “Working with The Prince’s Trust, I am joining the mission to help transform the lives of disadvantaged young people living in under-privileged neighbourhoods in the UK.”

He added: “My donation to The Trust will help these young people build skills that are vital in today’s and tomorrow’s job market including technology and computer knowledge.”

The funds will enable The Trust to provide enhanced support to young people, encouraging and developing key computer skills via XL, its education programme, its enterprise programme, and Fairbridge, its personal development programme.

“The Prince’s Trust is a charity which depends on generous donations such as these,” said Martina Milburn, chief executive of The Prince’s Trust.

She continued, “will.i.am is an inspiring character – we’re excited about his vision of helping the most disadvantaged to improve their computer skills and we’re incredibly grateful for the donation. It will make a huge difference to vulnerable young lives in the UK today.”

Littlewoods heir’s philanthropy to end after 50 years

After 50 years of charitable work Sir Peter Moores is ending charitable donations through his foundation, which has given more than £215m to the arts, education and health.

As one of the UK’s most active philanthropists, his money has particularly helped benefit opera and the visual arts. To mark the end of his philanthropic work there will be one final project involving eight opera companies that Sir Peter has been closely associated with over the years.

Now aged 80, he stated that he was spending what funds were left in the ways he wanted it to be used. He did not want to continue the fund after his death. “You can’t trust anyone to do what you would have wanted because if they’re any good, and you wouldn’t use someone who wasn’t any good … they’ll have their own ideas.”

You can’t trust anyone to do what you would have wanted because if they’re any good … they’ll have their own ideas.

The announcement comes as the debate over public versus private funding of the arts is at its height. Many in the arts fear that the government is planning more cuts to what is widely-regarded as a British success story, with the culture secretary Maria Miller telling arts organisations they need to be better at asking for private cash.

A lifelong fan of the arts, Moores began supporting young singers around 1952 and recalls working at Glyndebourne – organising taxis and buses – and offering to help Joan Sutherland. “I’d read about her coloratura training so I went to her dressing room and said, ‘Could I give you some money to get the training you want?’ She said, ‘Of course you can!’ I helped her for two or three years until she said, ‘I think I’ve got enough now’.”

He said the fund was in the process of using up its capital and it will vacate its London office in about two weeks. It will not officially end its activities until April 2014, 50 years after Moores set it up.

The foundation’s final act will be to support projects including Birmingham Opera in creating a site-specific production of Mussorgsky’s Khovanshchina in 2014, Opera North in staging Verdi’s Otello for the first time in its history, the Scottish Opera in celebrating Wagner’s bicentenary with a new production of Der Fliegende Hollander, the Royal Opera’s UK premiere of George Benjamin’s Written on Skin and Glyndebourne’s staging of Donizetti’s Poliuto in 2015. Other projects involve English Touring Opera, Welsh National Opera and English National Opera.

Over the years the foundation has helped a wide range of projects from the establishment of a slave trade gallery in Liverpool, to bursaries and scholarships for young singers, to championing the work of record label Opera Rara.

Waitrose to make extra Christmas donation

In addition to the £600,000 donation Waitrose would normally make in December, the supermarket chain plans to donate an extra £1m to charities over Christmas.

The company has decided to forgo some of the usual expenses associated with running a Christmas advertising campaign by featuring a cut-down Christmas TV advert, featuring Delia Smith and Heston Blumenthal in an empty studio.

The money saved will be put into the company’s ‘green token’ scheme, which enables customers to choose a local charity that will benefit from a donation.

In addition, waitrose.com will share a donation £25,000 between three national charities, the RNLI, Child Bereavement UK and the Multiple Sclerosis Society.

Online shoppers can also choose which charity to support with their ‘vote’ once they have completed their purchase at Waitrose.com. In the six months to February 2013 they will determine how £150,000 is distributed amongst the charities. This is £100,000 more than the amount Waitrose would normally donate on behalf of online shoppers in that period.

Golf club makes hefty donation

More than £30,000 has been raised for the Florence Nightingale Hospice Charity thanks to the fundraising efforts of The Oxfordshire Golf Club.

The donation, which will go towards providing accessible and free-of-charge palliative care within the community, came to £30,100. The cheque was presented by Marcus Simmons, club captain.

The most notable fund-raising event was the Captain’s Charity Golf Day in June which raised more than £25,000. The captain also raised money by donating a sum for every par and birdie he achieved this year.

Report: ‘UK Corporate Citizenship in the 21st Century

This month we have included a summary of a report on corporate giving conducted by Catherine Walker, Cathy Pharoah, Marina Marmolejo and Denise Lillya on behalf of the Centre for Charitable Giving and Philanthropy.

The report, entitled ‘UK Corporate Citizenship in the 21st Century’, asks: What is the private sector’s role in society?

The paper outlines the history of the sector’s wider role, referred to here as ‘corporate citizenship’, and, bringing together a new analysis of corporate giving data, focuses specifically on the ways in which UK-listed companies currently support the communities in which they operate.

Key findings

- Donations to UK charities by corporates are estimated to total around £1.6 billion annually.

- Of the top companies’ community support portfolios to non-profits in the UK cash donations make up around 70%, with the rest being in-kind donations, such as that of goods and services, specialist pro bono contributions and employee time.

- Donations to non-profits in the UK from the top 300 UK‑listed companies are estimated to make up around 70% of their overall worldwide community investment portfolio (excluding major product donations). The remaining 30% goes to causes internationally.

- Corporate donations to UK charities by the top givers fell by 4.3% in real terms between 2007/08 and 2008/09.

- Donations to communities internationally fell by 1.4% over 2007/08 and 2008/09 (excluding major product donations), before picking up by 0.7% in 2009/10.

- The on-going recession appears to have accelerated the trend of corporates shifting away from cash donations towards in‑kind giving.

- The top corporate givers are identified as healthcare and pharmaceutical companies. However when large product donations are taken out of the equation the financial and mining sectors appear to dominate in terms of corporate giving.

- The reporting of corporate giving is highly variable. The relatively low take‑up of any one standard measure makes it difficult to accurately assess the complete picture.

- Research evidence suggests that companies with a more social focus do better business in the long run. Thus those businesses perceived as “good corporate citizens” could have an advantage in terms of recession‑proofing.

What is corporate citizenship?

The report notes that many both within and outside the private sector argue that corporate organisations have a wider role to play in society beyond creating employment, providing goods and services, and generating profit for shareholders. Key to this argument is the notion that good corporate citizens have the same fiscal, environmental and social responsibilities to the communities in which they operate as do individuals.

In recent years legislation has been introduced to the UK requiring companies to report on social and environmental issues. The report focuses its attention on the less-well-regulated area of corporate social responsibility or CSR – generally manifested in relationships between companies and charities and community groups – and the support companies provide to the same groups in the form of corporate community investment, or CCI – which takes the form of both cash and in-kind gifts.

Corporate social responsibility

As well as the more common term ‘Corporate Social Responsibility’, the report notes that many related terms exist to describe the wider role business – in their efforts to achieve the status of good corporate citizens – can play in society. These include ‘corporate social performance’, ‘sustainable responsible business’, ‘corporate social profitability’ and ‘corporate philanthropy’.

The existence of many different ways of describing the efforts of corporations to impact positively on social welfare – along with the lack, apparently lamented by the report, of a “single comprehensive definition of corporate citizenship” – presents a further barrier to understanding and expectations by both companies and non-profits, in terms of how the former should invest in the latter to benefit wider society.

The report cites the The Guide to UK Company Giving (DSC, 2009 and 2011), which suggests that the “ideal CSR model” should allow a company to “assess its impact on society, with measurable targets where possible.” Specifically, it should facilitate:

- the monitoring and review of its ethical, environmental, health and safety procedures

- employees’ welfare and

- the effect that carrying out its business has on customers, suppliers, stakeholders and communities.

Corporate community investment

The aforementioned Corporate community investment (CCI) is a term often used in the non-profit sector to denote the contributions, both cash and in-kind, received from companies to have an impact on their local communities.

The report states that CCI is “the more easily measureable” part of overall CSR – it is therefore often used as a proxy for it.

Over the last two decades the UK has witnessed growth in CCI, moving in many cases from a “marginalised philanthropic function” to a more central business activity.

The report identifies the main types of CCI as being:

- Cash Donations: monetary gifts, with or without attached conditions.

- Payroll Giving: the enabling of employees by their employers to donate to charities through the payroll from their pre-tax earnings. This results in a tax-break for the donor.

- Matched Giving: the matching by employers of employees’ donations of time or money to charity.

- In-Kind Support: non-cash contributions of goods or services (including computers, meeting space, tax advice).

- Partnerships: longer-term arrangements, not just for specific projects, whereby charities share their strategic objectives with a corporate and gain general support.

- Employee Fundraising: informal or formal ‘adopted charity’ fundraising projects led by employees.

- Cause-related Marketing: a commercial partnership for mutual benefit between a charity and a corporate to market an image, product or service.

- Secondments/placements: opportunities for staff of either corporates or charities to “live in each other’s shoes for a period”, enabling them to learn from one another.

- Employee Volunteering: one-off team-building events and on-going volunteering arrangements for staff to give their expertise as services. Charities might otherwise have to pay for such services, which may include legal advice, web design or marketing.

- Mentoring: wisdom and experience or corporate staff provided to charities.

The report touches upon the lack of data in the area of CCI, leading to difficulties in estimating the level of company giving in this manner.

Two central ways of approaching estimates are identified, either measuring donations at source or at destination. The NCVO’s biennial Almanac, for example, uses the latter method, gathering figures from a sample of UK charities’ annual returns to estimate the total value of CCI; the report notes that such a method “cannot hope to capture every corporate gift”. By comparison deriving estimates from companies’ own report, while allowing the reasonable comparison of top corporate givers year by year, is fraught with its own difficulties.

Estimates of corporate giving in the UK

The report, drawing from NCVO data from 2012, estimates that total value of corporate support from firms to communities in the UK at around £1.6 billion annually. Drawing information from other sources (including 2011 data from the DSC and CGAP/CaritasData), the report gives this figure as representing less than 5% of UK charities’ total income and around 3% of private cash giving in the UK.

In the case of the top 600 corporate givers (as defined by the DSC in 2011), £762 million was given to charities in 2008/09, £512 million of which was estimated to be cash donations. It is estimated that cash giving “currently forms around two-thirds (67%) of total corporate support to UK charities”, the rest being made up of in-kind giving of one form or another.

Corporate foundations

Most corporate foundations have the status of being separate entities from their corporate parents, even if in some cases those foundations form part of a company’s overarching CSR programme or share staff with their parent. The report notes the claim that, as separate bodies, “corporate foundations provide a more transparent structure for CCI, supported by the credibility of meeting the legislative and reporting requirements of the Charity Commission”.

The report cites research suggesting that corporate foundations escape demands for transparency. Information regarding income levels and spending is simply ‘not asked for’.

It is clear that companies, as being primarily established for purposes other than the support of good causes, will have different practises and policies from grant-making charities. However, corporate foundations, in being registered as grant-makers, become bound by UK charitable law. In addition, the statement of purpose provided by charitable deeds and annual reports’ illumination of their activities allow non-profits to more easily identify those corporate foundations whose remit matches their own activities and objectives.

However, the report cites research suggesting that corporate foundations escape the increasing demands for transparency regarding CSR activity. Their perceived distinction from the corporate parent means that information regarding income levels and spending is simply “not asked for”.

The benefits of CSR and CCI for companies, charities and society

The report cites a number of benefits for charities and wider communities via CSR, including cash or in-kind support, access to skills and knowledge and long-term partnerships.

The report avers, citing a “number of research studies” that CSR – especially where including CCI strategies – can improve the outcomes of corporate branding and marketing exercises. Within business, beneficial effects may be seen on “employee morale, skills and on their relationships with suppliers.” From an outside perspective the association with charitable organisations or good causes can lead to increased sales and market share. (Though not mentioned by the report, it may be surmised that some charitable associations run the risk of alienating certain markets, who may perceive the work of associated charities in a less-positive light.)

The challenges of CCI for companies, charities and society

Whenever engaging in CSR activity charities run the risk of a “perceived discrepancy” between the support offered by corporates and their own needs. The report gives the example of the increasing tendency of companies to offer unskilled volunteering time rather than cash donations. However such provision of unskilled time can in actuality lead to greater costs; certainly some charities perceive such support as being “without great value”.

What next for CSR and CCI? Conclusions and recommendations

In 2010 the NCVO Funding Commission, cited by the report, stated that “effective CSR programmes are those that not only bring mutual benefit to companies and CSOs [civil society organisations], but also have an impact on the ground, with the people and communities they work with.” The Funding Commission also expressed the hope that the “current financial climate” might heighten the importance of “establishing the right ways to share information, open up dialogue and establish ways to benefit both [the private and non-profit] sectors.”

Effective CSR programmes are those that not only bring mutual benefit to companies and civil society organisations, but also have an impact on the ground.

The Corporate Giving report states that “[c]hanging the way companies think about their responsibilities could alter this.” Central to this change is the recognition, arguably needed in much of the private sector, that markets are not just defined by economic needs, but social needs. While social harms can create costs for private firms in the form of wasted energy and/or materials, or accidents, while reducing the same harms “does not automatically raise costs for firms”. Such reductions, by allowing firms to innovate and adopt new operating or management methods, can allow them to increase their productivity.

While acknowledging that the UK is perceived as a leader in the field of CSR, the report closes by calling for increase legal obligation for companies in this area. At the same time, standardisation is identified as crucial, along with “better reporting [and] transparency”. Policy towards corporate citizenship should be “up-to-date and crystal clear”. Finally the report draws attention to the conclusion, demonstrated in several studies, that maintaining social responsibility as a core company policy – rather than a luxury to be abandoned in tough times – increases those companies’ ability to weather difficult economic times.

Phi in Numbers: Database Update July 2011

[Note that the above chart reproduces the same set of data twice. Owing to the overwhelmingly large number of donations to education/training as found in the public domain, the lower version of the chart focuses on all other activity/types, allowing more clarity in comparison.]

As can be seen, the largest recipient category is Education & Training, with a total of 65,149. It is doubtful that this number of public-domain recorded donations to education as compared to other activity types accords with the number of real-world donations; instead it is much more likely to reflect the level of donation reporting by educational institutions. Given that educational institutions recieve a large number of donations from their alumni, they may and do publish the names of all donors without fear of loss to competing organisations.

As corroboration for the above, it is notable that excluding all individual donors from the dataset results in a graph showing a much more graduated progression from Education & Training to the following categories (above). (A significant drop in the number of donations to Arts & Culture is also noticeable.)

Referring once again to the full dataset, following on from Education & Training is Arts & Cultures, with a total of 4,599 new recorded donations. Following this comes Health with 3,703 donations.

Profile: The Bernard Sunley Charitable Foundation

The Bernard Sunley Charitable Foundation was established in 1960 by entrepreneur and building contractor Bernard Sunley. He started as a landscape contractor in the 1920s before diversifying into open cast coal mining, airfield excavation and construction.

The foundation was first endowed with a pledge of £300,000 worth of shares from Bernard’s property company. After his death in November 1964 his son John took over the running of the business with great success., John commissioned a Jubilee Celebration book in 2011, 50 years after the trust’s establishment, that recorded the achievements of the £80 million foundation. To date it has made grants of over £92m to a wide range of charities.

Factary Phi records donations totalling £8,668,272 made by the foundation since 2005. The average size of donations made by the foundation is £5,937.

In 1960, John Sunley joined the boards of Blackwood Hodge Ltd and the Bernard Sunley Investment Trust (BSIT), the two public companies his father had built up since he started as a landscape contractor in the 1920s. Blackwood Hodge was the world’s largest distributor of earthmoving equipment, notably Euclid, whilst the BSIT construction subsidiary Bernard Sunley & Sons became a household name responsible for such landmark buildings as Manchester’s Piccadilly Plaza, the Horseferry Road Government Buildings (‘The 3 Graces’), the Gatwick Airport Terminal and the Royal Thames Yacht Club.

In the 1970s John spearheaded the group’s move into the Middle East, winning contracts for hospitals, police stations, banks and apartment complexes throughout the Gulf. In 1979, the year he became Chair of Sunley Holdings, the Queen opened the Sunley-built Dubai World Trade Centre.

Later John Sunley’s attention focused on development projects in the United States, while continuing to manage the family property, farming and venture capital interests as well as giving his time to a wide range of charities.

In February 2011 John Sunley died unexpectedly after a short illness. His daughter, Mrs Anabel Knight, now serves as the Chair of the foundation.

The foundation reported an income of £3,217,000 and an expenditure of £3,055,000 in the financial year ending 30th November 2012, of which £2,548,619 was spent in the form of grants. Factary Phi records 1543 donations made to various organisations totalling £8,668,272 since 2005. Of those the largest single recorded donation, to the value of £500,000, was made to Turner Contemporary Gallery in 2005. The average size of donations made to charitable causes by the foundation is £5,937, according to Phi’s data.

The number of recorded Phi donations are listed in the following sub-categories:

- Children/Youth related causes (454 donations)

- Development (229)

- Health (189)

- Welfare (160)

- Education (120)

- Religious Activities (111)

- Arts & Culture (76)

- Sport (54)

- Elderly (30)

- Animals (25)

- Rights (15)

- Environment (15)

- Heritage (11)

- Mental Health (3)

- General Charitable Purposes (2)

The Trustees

Sir Donald Gosling joined the Royal Navy in 1944 and served on the HMS Leander. After the war, he founded Central Car Parks with partner Ronald Hobson. They went on to make their fortunes building the NCP car park empire and dealing in property. Gosling is a former president of naval charity the White Ensign Association. He is also a Trustee of the Gosling Foundation Ltd, The Hobson Charity Ltd and The Saints and Sinners Charity Ltd.

Anabel Knight is a grandchild of Bernard Sunley and the current Chair of the foundation.

Bella Sunley is a former Trustee of The Kennedy Trust for Rheumatology Research.

Joan Sunley Tice is a Director of JMT Corporation Ltd and JMT Settlements Ltd. She is also a Trustee of the Northamptonshire Association of Youth Clubs, Northamptonshire Independent Grammar School and Sunley Oxford Retirement Homes.

William Tice is a Consultant Orthopaedic Surgeon with Southampton University Hospitals NHS Trust. He is also a Fellow of the Royal College of Surgeons and a member of the British Orthopaedic Association.