Welcome to the March 2014 issue of the Factary Phi Newsletter.

Major Giving News

College nets £1.1m

Investment banking firm Goldman Sachs are set to donate £1.1m to Exeter College, Oxford.

The donation has been made as part of the bank’s charitable arm ‘Goldman Sachs Gives’, and it has been donated on the condition that £30,000 per year will be set aside, and used to provide financial support for students via a specially set up hardship fund.

Frances Cairncross, the college’s rector said ‘This very welcome gift from Goldman Sachs is tied specifically by the donor to relieving student hardship. It will be added to our endowment and will allow us, under our spending rules, to use just over £30,000 a year to help students in financial need.’

Historically, the bank has also supported a number of different educational institutions, including Eton, Balliol and Christ Church in recent years.

Exeter students, who have just stopped a hall strike to protest the college’s £840 annual catering charge, welcomed the grant. Rowan Lennox, who is a second year student commented, ‘Great to see the much maligned finance sector making a serious contribution to social mobility.’

Mystery donor gives hospice £100,000

Ellie’s Haven, a children’s hospice based in Cornwall, is set to receive £100,000 gift from an anonymous donor.

The new donation will be used to fund the construction of a specially adapted base for the hospice that will allow staff to better support their patients.

Speaking on the donation, Nigel Libby, who is the hospice’s general manager and co-founder said: ‘This is a fantastic breakthrough for us’. ‘We only need one final big push on fundraising and we should be able to start building later this year’.

A pledge for matched funding has also been made, meaning that every further pound raised by Ellie’s Haven will also be matched by the anonymous trust.

The hospice purchased a property in Duloe, near Liskeard, in 2012 and has plans to extend and adapt it so that it’s suitable for special children with complex medical conditions.

Cancer Trust to receive £30,000

The Chartwell Cancer Trust is set to receive its largest ever single donation thanks to the Chislehurst Golf Club.

A cheque for the donation was presented by the club members, Pete Skinner and Susie Mathews to Michael Douglas, who is one of its trustees.

Speaking on the donation, Michael Douglas said ‘We are all most grateful for the support from the Captains and the efforts they have made throughout the year.’

The money will be used to provide the Chartwell cancer and leukaemia unit in the Princess Royal University Hospital with continued financial support.

Report: Surveying Investment in the Charity Sector

This month, we have included our summary of a recent survey on investment in the charity sector.

The report, appropriately entitled ‘Surveying Investment in the Charity Sector’, is intended to produce a benchmark guide for charities that will enable them to compare themselves against their peers. The other reason for this survey, it is stated, is because over time investments have taken an ever more prominent role in the success and development of charities. This is partly due to economic factors, and also because of an increasing dependency on investment income for a number of organisations. This report was researched by accountancy firm Deloitte LLP.

The survey’s objectives, basis and methodology

This survey’s main objective is to consider the quality of the investment information that is typically presented in the annual reports of sample charities, and to see how this compares from different sources across the sector.

In addition, the survey also considers the various different types of investments held, managers’ fees and also charities’ portfolio information in order to develop some form of trend analysis.

The survey was conducted by obtaining a list of the top 1000 charities by income in the UK from the Top 3000 Charities 2012/13 publication produced by CaritasData. The sample selected comprised 100 charities from the list of the top 1000 charities ranked by income. From these, 20 were then randomly selected, with a further 20 from those ranked 101 to 200 and 20 more were randomly selected from the top 1000 charities list as a whole.

Types of investments

Although there are several different types of investments made in charities (such as ‘financial’, ‘programme’ and ‘social’ investments), the point is made in the report that very few charities usually receive anything other than typical financial investments from their backers. Of course, many charities themselves can also potentially make social or programme related investments to further their aims. However it was found that it was largely bigger charities who were contributing the most in this regard, with around 20% within this group having made some type of alternative investment.

Conversely, the largest number of charities with only basic investment holdings came from the smallest charities segment of those surveyed. Sitting in-between these two groups, middle sized charities who were sampled were found to have the most active investors overall.

Across all charities sampled, the survey found that cash balances were maintained at a relatively high level, with an average balance of £8.5m. Furthermore in the top 100 surveyed, balances were high even where other investments were held, which suggests a conscious decision to maintain high cash balances. This was reflected in a number of accounting policies that focused on the need for liquidity and short term deposits to manage charity activities and being ready for potentially short notice cash calls.

Trustees investment powers

By a large, trustees’ powers to invest are quite broad, however some restrictions obviously exist. For example, many of these restrictions are often imposed by trustees based on the ethical policies of the charities they represent. Indeed, while the SORP (Statement of Recommended Practice) does not specifically require charities to clarify their investment powers, they are required to give details of their policy, along with any other considerations that must be taken into account.

Of those charities surveyed, 35% did give information on their investment powers, which is useful to know as it allows the reader to distinguish between restrictions imposed by law and those imposed trustees reflecting the ethics and risk approach of the charity.

Investment policy and objectives

The SORP does require that where material investments are held, investment policies and objectives are to be disclosed. From those surveyed, 8% did not comply with the requirement despite having financial investments other than cash and subsidiaries.

Of those charities with investments in cash and subsidiaries only with no other types of investment, 34% included a policy which, broadly speaking, explained the charity’s need for cash and very liquid deposits.

Of the total number of charities surveyed, 21% had no discussion of any trustee-imposed restrictions and 9% explicitly stated that there were no trustee-imposed restrictions on the investment powers.

Furthermore, charities are also required to state their investment objectives as part of their policies. The survey found that while 74% did disclose a policy, only 64% of charities were clear about their objectives. From those that did, there was variety in both their objective and the clarity with which it was expressed.

The SORP also stipulates that where material investments are held, their performance should be compared to the charity’s objectives set. 66% of those surveyed with financial investments other than subsidiaries and cash were found to include discussion of investment performance. However, only 30% of those including a discussion of investment performance directly assessed their performance against targets either wholly by discussion, or through including a numerical target or result.

From those charities that included these discussions, the charities in the 201-1000 survey bracket were more forthcoming in terms of their targets and results. One reason for this might be that the simpler nature of the funds and investments make an easier target to describe and summarize. However, this report points out that larger charities should perhaps consider this further, particularly given the size of their own investment holdings.

Trustees responsibilities

According to SORP regulations, charities are required to disclose certain information on their trustees and other members of their senior management team. These regulations also allow trustees to delegate their responsibility for investments either through a committee or to an investment manager.

When such delegations are made, trustees do retain a certain amount of responsibility in terms of establishing a contract and monitoring performance against that contract, or the terms agreed. Of those charities who were surveyed, 59% retained the power of management of investments with the full board, 29% stated that they had a subcommittee who would fulfil this role, while 12% delegated directly to an investment manager.

Of those who referred to an investment or advisory committee, 49% chose to give further information on the membership of the committee. 75% of these had 2-5 trustees, no committees had just one trustee, and a quarter had six to ten trustees.

Furthermore, 76% had at least one investment manager, with just 7% having over 3. Perhaps unsurprisingly, those with the highest number of managers also tended to have the most segregated types of investment or portfolios with varying objectives.

Benchmarking objectives

This section of the report is intended to set out the survey’s findings in respect of the investment information given by charities in their annual reports.

Cash and investments

On average, cash and investments contributed to almost 40% of the value of the gross assets of all charities sampled, demonstrating the significance of the decisions being made trustees around cash and investments.

The survey results have also demonstrated that the average value of investments decreases with the size of the charity in question. However, the proportionate importance of investments within the charity’s assets increases. Thus, while investments account for on average 30% of the top 200 charities gross assets, they are 42% of those sampled in the 201-1000 category. Other significant assets held in the sample were tangible and heritage assets.

Portfolio Cash

Cash holdings within a portfolio are considered to be significant by the report, as they can, perhaps, reflect the sense of uncertainty surrounding equity investments that has been present since the economic dip of a few years ago. However with this in mind, interest rates and investment returns for such balances have remained comparatively low, and in line with the Bank of England’s base rate.

The need for liquid assets has also been mentioned in a number of reports in terms of investment requirements and strategy. This is corroborated by the results of the survey, which shows that the largest charities to have been sampled are holding significant cash balances (24% of their investment portfolio compared to an average 18% for other charities).

Investment Return

It is also noted that, the return on investments for charities can be judged in a number of different ways, and this is of course dependent upon the investment strategy and the mix of different investments for the charity in question.

For example, where charities hold investments for the long term, unrealised losses may reflect the market movements but may not be significant to charities, as those losses only crystallise if the asset is sold. From the survey results, the smaller charities appear to significantly buck the market trend.

However, part of this result appears to be due to the particular investment mix of the charities in the 101-200 bracket of the sample, and in particular, charities’ investment property holdings.

The report also asks how important this investment return is to charities, noting that while investment balances are high and back long term security, the income generated from these assets may be relatively low compared to the income from charity’s other activities.

Fees

According to SORP regulations, charities are required to disclose their investment management costs. However, 42% of the charities surveyed did not make clear what their cost of investment was.

The report also notes that even when these were disclosed, there were some potential issues in comparability, as the money may potentially be a combination of both the feeds paid to the investment manager and also any additional costs associated with the underlying funds themselves, depending on the level of detail available.

With this is mind, the results of the survey show that investment management costs are, on average, just below £40,000 for the charities in the 201-1000 bracket; however the top 200 charities’ costs are on a par with the average disclosed, being just below £130,000. These feeds were on average approximately 8% of the investment income received.

Furthermore, average fees were 0.25% of investment balances (excluding cash balances held outside portfolios), with smaller charities paying slightly more at around 0.4% and the larger charities correspondingly less.

This month, we have included our summary of a recent survey on investment in the charity sector.

Clickhere for a full version of the report.

Phi in Numbers March 2014

Recent uploads to Phi have included donations made by 135 of the largest UK trusts and foundations. These grants (uploaded between December 2013 and February 2014) have amounted to 27,000 records awarded to more than 5,000 different organisations. The total sum granted was £1.69bn – an average of around £62,000 per grant.

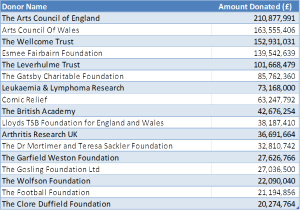

The largest (most generous) grant-makers represented in this upload have been:

Of these, most come as no surprise, with the scale of the donations made by Leukaemia & Lymphoma Research, Arthritis Research and the British Academy perhaps standing out.

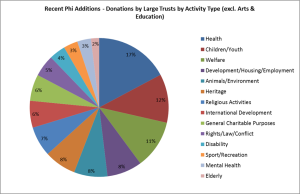

The sectors strongly represented include Arts/Culture and Education/Training which between them received over £1bn – 63% of the total. In the case of Arts/Culture this is inevitably driven in large part by donations made by the various Arts Councils. In the case of Education/Training large donations are being made to universities by organisations such as the Wellcome Trust and other research based organisations such as those listed above.

Putting these sectors to one side, other areas receiving significant levels of funding from the largest trusts in the country are health, children/youth and welfare. The relatively strong spread of donations across all sectors is also noticeable with traditionally harder to fund areas such as mental health receiving a decently sized slice of the remaining pie – in large part due to Comic Relief and the Lloyds TSB Foundation for England and Wales.

Top political donors are well documented by the media, making this perhaps the highest profile form of donation activity in the UK, but Phi can serve to quickly confirm the combinations of activities being undertaken by some of these high profile individuals. Andrew Rosenfeld for example emerges from Phi as a supporter of the NSPCC and Jewish Care alongside his Labour Party involvement – a pattern which is confirmed by public domain sources.

Political donations made by companies are perhaps less often reported than those made by individuals. Companies donating over £200,000 to the Conservative Party between 2011 and 2013 include JCB Research (£575,500), Lycamobile UK Ltd (£329,030), International Motors Ltd (£310,000), IPGL Ltd (£299,181), Shore Capital Group plc (£271,770), Flowidea Ltd (£268,450), David Ord Ltd (£257,820), Bestway Cash & Carry Ltd (£204,950) and Westfield Shoppingtowns Ltd (£201,270).

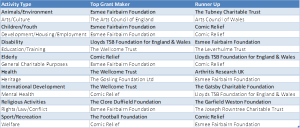

The largest trust in each of these sectors (in terms of total grants awarded) is shown in the table below. The greatest surprise is perhaps the relative importance of the Esmée Fairbairn Foundation across a number of charitable sectors.

The Wellcome Trust tops the list of International Development donors due to two large grants (in excess of £10m in total) made to DFID to support health research capacity strengthening (HRCS) activities taking place in Malawi and Kenya.

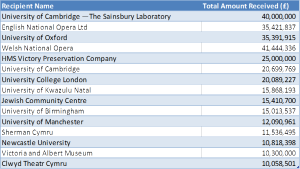

The most successful recipient organisations are inevitably skewed towards arts organisations and universities given the nature of the grant makers involved. Within this, however, the largest total grants appear to have been awarded to the University of Cambridge, the University of Oxford and to the English and Welsh National Opera companies. Other major English universities (UCL, Birmingham, Manchester and Newcastle) and Welsh arts organisations (Sherman Cymru and Clwyd Theatr Cymru) have also been highly successful at attracting grants from the largest grant making organisations.

The £40m donation to the Sainsbury Laboratory at the University of Cambridge represents a single donation from Lord David Sainsbury’s Gatsby Foundation. Similarly, the £25m donated to the HMS Victory Preservation Company is a single donation from Sir Donald Gosling’s foundation.

Notes

- All analysis is based on the donations recently uploaded to Phi and therefore includes donations from a number of years for certain grant-makers and only one year for others. This inevitably introduces an element of bias to the findings.

- Differences in the spelling or formatting of organisation names between different grant makers at times limits our ability to combine donations – which have in fact been received by the same organisation.

- One primary activity type has been taken in each case for analysis purposes. In the case of some organisations this may not give a full representation of their activities.

Profile: The R and S Cohen Foundation

Founded in 1999, The R & S Cohen Foundation was created by Sir Ronald Cohen, Chair of Bridges Ventures Investment Company and his wife, Lady Sharon Harel-Cohen, who is a film producer.

Sir Ronald is Egyptian born, but in 1957, he immigrated with his family to the UK in the wake of the Suez Crises. With little choice but to escape the conflict, the Cohen family were forced to abandon all their assets and flee Egyptian President Nassar’s persecution of its Jewish population.

Once in the UK, the young Ronald attended Orange Hill grammar school in North London, despite at first speaking very little English. After finishing school, he won a scholarship to Oxford University, where he was President of the Oxford Union, and earned a degree in Philosophy, Politics, and Economics at Exeter College, before subsequently attending Harvard Business School.

After finishing his education, Sir Ronald began his business career working as a management consultant for McKinsey & Company in both the United Kingdom and Italy. By 1972, he had founded Apex Partners with two friends from business school as his partners.

One of Britain’s first venture capital firms, the company has grown to become one of the largest in the country, with a global presence in terms of its investments. He is its former Chairman, and remains a Director of the company. Sir Ronald and Sharon are also ranked on the Sunday Times Rich List 2013 with an estimated wealth of £220m based on their combined business interests.

For the financial year ending the 31st of December 2012, the foundation reported an income of £15,503 and an expenditure of £1,254,046. Factary Phi holds 173 records of donations made to various organisations since 2006 worth a minimum of £9,662,705.

From these records, the average size of donations made is £57,175 and the largest number of donations have typically been made to causes associated with Arts/Culture (36) followed by Education/Training (29), Religious Activities (19), Children/Youth (18), Health (16), Welfare (14), General Charitable Purposes (10), Rights/Law/Conflict (7), Heritage (6), Disability (5), Development/Housing/Unemployment (5), International Development (4), Sport/Recreation (3), Elderly (1).

The Trustees

Sir Ronald Cohen

Sir Ronald Cohen is currently Chairman of Big Society Capital, Bridges Ventures and he is a Director of non-profit investment company Social Finance. Prior to this, he was a founding partner in investment firm of Apax Partners where he was Chairman. He is also a member of the Harvard Board of Overseers, on the Board of Dean’s Advisers at Harvard Business School, a Vice-Chairman of Ben Gurion University and a member of the University of Oxford Investment Committee. As well as this, he is also a Trustee of the Michael Cohen Charitable Trust and The Portland Trust where he holds the position of Chairman. We also find several individual donations made by him on Phi to the Labour Party, The London Library, The Cricket Foundation, The Royal Academy of Arts, the Royal Shakespeare Company and the British Museum.

Lady Sharon Harel-Cohen

Lady Sharon Harel-Cohen is a film producer and co-founder of Capitol Films, a production company that has been involved with notable films such as Gosford Park. The company was sold in 2006, and she owns a £2.3m stake in Pulse, also a film production company.

Tamara Harel-Cohen

Their daughter, Tamara Harel-Cohen works for Pulse Films.

Jonathan Harel-Cohen

Their son, Jonathan Harel-Cohen works as a business analyst for McKinsey & Company and he has previously held positions as a summer analyst and business analyst for the Monitor Group and Artemis Investment Management.

David Marks

David Marks is tax Director of Apax Partners LLP. Before holding this position, he was a tax Partner with Deloitte LLP and also Andersen. He is currently a Trustee of the Apax Foundation and the Marks Family Foundation.