Welcome to the April 2014 issue of the Factary Phi Newsletter.

Major Giving News

Maria Miller to donate pay-off to charity

The MP and former culture secretary, who has recently resigned from her position in the face of public pressure, is set to donate £17,000 to autism and learning difficulties charity Speakeasy Advocacy.

She resigned from her position earlier this month in the face of mounting criticism regarding her expenses claims and the Commons standards committee have also ordered her to pay back £5,800 for money wrongly claimed on her second home.

According to parliamentary rules, the former culture secretary is entitled to a lump sum worth three months of her £68,000 salary. However Labour MP John Mann, who made the initial complaint regarding her expenses, has also called for her to reject this severance payment in light of her conduct.

Speaking on the matter he said ‘It would now be inappropriate for her to claim severance pay after her resignation,’ and further argued that ‘For her to accept a pay-off would be a further insult to the taxpayer.’

Birkbeck to receive £300,000

Birkbeck, The University of London is set to receive a £300,000 grant from the Exilarch’s Foundation to promote the study of monotheism.

Using this donation, a three year Dangoor Postdoctoral Fellowship and a three-year Dangoor PhD Scholarship will be created, and successful candidates will be directed and supervised by Professor Stephen Frosh, of Birkbeck’s Department of Psychosocial Studies.

As part of the research, the social, political and cultural realities of the major monotheistic faiths in the UK will be analysed.

Speaking on newly funded scholarship, Professor Stephen Frosh said: ‘This new research project will lead to a better understanding of the psychological and sociological dimensions associated with the monotheistic faiths. Its interdisciplinary focus will help generate new insights about the ethics, culture and politics of Judaism, Christianity and Islam. Religion plays a central role in societies throughout the world, including in our own secular society in the UK. As well as following religious doctrines and practices, people often turn to religion for individual spiritual guidance, and ethics has always featured prominently in religious discourse.’

Dr Naim E Dangoor CBE, who is a founder and Trustee of The Exilarch’s Foundation, said: ‘I am delighted that The Exilarch’s Foundation is supporting such an important area of research. The major monotheistic faiths continue to influence the lives of millions of people in the UK, and it is necessary to investigate the social, political and cultural impacts of these religions.’/p>

Freemasons donate £50k

The Provincial Grand Lodge of Surrey is set to donate £50,000 to a number of charities based in the local area.

Some of the organisations set to receive the cash include Cancer Research UK, MacMillan Cancer Support, The Children’s Trust Tadworth, The Royal Marsden Hospital, Surrey Air Ambulance, Trinity Hospice and also the Patient Welfare Trust in Headly Court.

John Milner, a spokesman for the Surrey Freemasons said: ‘Many Lodges and Chapters throughout Surrey have combined their funds to build the donations into worthwhile amounts including those from Masonic Centres at Surbiton, Croydon, Kingston, Chertsey, Sutton, Guildford, Godalming, Nutfield and Bisley.’

Report: In Demand: The Changing Need for Repayable Finance in the Charity Sector

The report is entitled ‘In Demand: The Changing Need for Repayable Finance in the Charity Sector’, and it is intended to improve understanding of the demand among charities for repayable finance and how this is changing. In terms of resources, it draws upon earlier research commissioned by CAF Venturesome and undertaken by Lake Market Research in partnership with Diagnostic Decisions. The findings are taken from 1,811 charities screened to take part in the research and 252 detailed surveys.

Introduction

The report begins by acknowledging the fact that, over the past 20 years, civil society has moved on from being funded solely by grants and donations. Instead, there are now a growing number of funders and investors who use a variety of different financial products to support community groups, charities and social enterprises.

While it is true that the majority of funding is still provided in the form of grants and donations, the use of social investment has become increasingly widespread given the wider range of revenue generation opportunities for charities.

This report aims to understand charities’ changing needs for not only social investment, but repayable finance more broadly. This includes all forms of repayable finance available, regardless of whether the investor makes an explicit trade-off between social and financial returns.

In the face of such increased competition for funding, and a higher demand for services in the current economic climate, the need for repayable finance and social investment has become ever more important as a means of alleviating the funding pressures for the sector. However, the point is made that effective use of this will require investors, intermediaries and policy makers to have a greater understanding of charities’ funding needs and their relationship with repayable finance.

Methodology

The report is based upon earlier research that was conducted through a quantitative online survey of 252 UK registered charities, developed by CAF and Lake Market Research in partnership with Diagnostic Decisions. To take part, interviewees had to:

- Be either primarily or jointly responsible for financial decision-making in the charity, or be senior members of the charity’s executive committee.

- Represent a charity with an annual income of £60,000 or more, as this is the minimum level of turnover required in a charity for CAF Venturesome to consider providing financial support.

- Either have experience of taking on finance or be ‘very likely’, ‘somewhat likely’ or ‘neither unlikely nor likely’ to take out repayable finance in the future.

How do charities feel about social investment?

The idea of ‘social investment’ as it applies to charities is still a relatively new concept in the voluntary sector. In particular, this research explores charities’ awareness of this term and their attitude towards it, separately from the wider category of social finance.

According to the results of the survey, only 37% of respondents had a fair or better understanding of the term ‘social investment’. Despite this however, the findings suggested that charities are still very much open to the idea of new funding models. Two thirds of respondents expressed an interest in being innovative in terms of the way their activities are financed.

Among those that were aware of the term, 71% agreed that it was an appropriate financing option for charities, and encouragingly, over half of respondents also agreed with the statement; ‘social investment is better for charities than mainstream commercial finance’. According to the research, it is the bigger charities (those with annual income of £1m of more) that are the most familiar and receptive to the prospect of taking on finance. This may be because, it is thought, larger charities are likely to have a more experienced management team and trustee board.

Indeed, charities that have taken on repayable finance in the past are also far more likely to be confident of their ability to repay new finance, and, they also feel that they have more access to the right kind of support when considering borrowing.

Charities that expressed a clear intention to take on repayable finance over the next five years were also more likely to have the following discernible characteristics:

- Trustees and executive team are open to the idea of repayable finance.

- Past experience of repayable finance

- Income in excess of £1m

How will charities’ demand for repayable finance change?

This report is also intended to identify and understand the changing demand for repayable finance among charities. For this reason, analysis was not simply restricted to social investment products in order to understand the wider need for finance accessible to charities. This was done by analysing:

- Borrowing characteristics in relation to the last finance facility taken on, compared with expectations of future borrowing decisions.

- Attributes of borrowers

- Size of borrowings, current and anticipated.

The changing purpose, type and source of repayable finance taken on

As part of the research, charities were asked how they expect their largest funding source to change over the next five years in comparison with the previous five. Perhaps unsurprisingly, the significant perception amongst those surveyed was that government funding, either through grants or contracts, will most likely decrease.

In the last five years, 33% of charities identified government funding as their main source of income. Looking ahead, only 25% of charities believe that government funding will be the main source.

When considering the changing characteristics of investments among charities, the purpose, type and source of charities’ last instance of repayable finance was also compared with borrowing expectations over the next five years.

Why is finance taken on?

In the last five years, 33% of charities identified government funding as their main source of income. Looking ahead, only 25% of charities believe that government funding will be the main source.

What financial products are used?

When considering the changing characteristics of investments among charities, the purpose, type and source of charities’ last instance of repayable finance was also compared with borrowing expectations over the next five years.

Who provides the finance?

The majority of finance (53%) historically taken on by respondents came from high street lenders, and indeed, this is considered unsurprising given the aforementioned need for mortgages and the prevalence of high-street lenders providing these.

However, as it has been discussed above, the funding ecology of charities looks to set to diversify over the next five years, with the use of specialist third sector banks and lenders, including social investment and finance intermediaries (SIFIs), envisaged to increase. Charities also anticipate that foundations and trusts will be seen as a major source of repayable finance in the future, despite their more limited involved in the market to date.

Further analysis also suggests that it is the larger income charities (£1m+) that will be more likely to include high street lenders within their future funding mix. According to the report, this may suggest a real need for specialist finance providers to cater for the needs of smaller organisations.

Based on this, it is clear that charities anticipate some significant changes in terms of their borrowing. Repayable finance will be more likely to be unsecured, non-longterm in nature and called upon for a wider range of purposes, and it is increasingly expected to be drawn from third sector orientated providers. This could reflect the growing profile of social investors, or equally, it could be a considered a reflection of the risks involved in this type of finance and the reduced likelihood of receiving it from high street providers.

Size of charity borrowing: now and in the future?

Of the 252 charities surveyed, just under half (46%) have acquired repayable finance in the past, and under a third currently have finance outstanding on their balance sheet (borrowings that are yet to be fully repaid).

For charities that have previously acquired repayable finance, the average amount outstanding correlates strongly with their income levels. Those with an annual income of less than £1m (the majority of those sampled) had an average of £109,000 outstanding, and charities with an annual income greater than £1m have around £1.1m outstanding.

As part of the survey, research was also conducted in order to understand how much repayable finance charities have successfully received in the last 12 months. This was done in order gauge the total market size in the period and although challenging to gauge accurately, the report estimates that this is between £320m to £980m, with a midpoint of £650m.

In terms of borrowing over the next five years, 38% of respondents describe themselves as being certain to or likely to seek repayable finance, 27% are unsure and 35% are unlikely or certain not to.

When asked how much they would like to borrow in this future period, the majority of respondents gave a figure of under £250,000 for a given loan purposes and over a third would borrow less than £50,000. However, the results of the survey have shown that charities who more certain in terms of their borrowing intentions also intended to borrow larger amounts.

Overall, more than half of those surveyed were also confident of their ability to repay any finance taken on. However, there are significant variances depending on the size of the charity, its previous experience of finance and intention to borrow in the future. The results indicated that it was larger charities, and those that are more certain to borrow who demonstrated greater self-confidence in terms of their ability to repay.

From the results of the survey, it is estimated that the average annual demand for charity finance over the next five years will be £765 million. £530 million (70%) of this is expected to come from charities with an annual turnover of £1 million or more.

Challenges and accelerants for the charity repayable finance market

An analysis of the attitudes towards repayable finance has revealed the following characteristics in charities that were either unsure, unlikely or certain not to take on repayable finance:

- Management and/or trustees that do not hold a favourable view of repayable finance.

- A lack of confidence in their ability to generate income and ultimately repay finance.

- Uncertainty over what repayable finance options would suit the charity.

- Uncertainty over whether they have access to support or advice concerning repayable finance.

Of those charities that were unlikely to acquire finance over the next five years, the attitude of trustees was considered to be the most significant barrier, followed by other factors such unaffordable costs, a lack of knowledge of the financial options available and the prevalence of technical financial language.

For charities that were likely to take on finance over the next five years, the significance of these perceived challenges changes a great deal. For example, knowledge of finance options and providers, as well as having access to support rank very high. Furthermore, having time to consider the availability and sustainability of differing finance options is also considered important. For this group of respondents, trustee attitudes fell to sixth place in terms of significant barriers, which further supports the finding that trustees are a significant, enabling factor in the decision to take on finance.

What would help charities access repayable finance?

For many respondents, a guide to accessing finance was considered to be the most useful piece of support for charities, regardless of their likelihood of taking anything on over the next five years. As this already exists, the challenge seems to be making this information more accessible, which in turn poses questions on how social investment and finance intermediaries can more effectively disseminate information on their own products and services.

In terms of finance products, further analysis shows take up of repayable finance is most significantly affected by the interest rate, followed by the size of up-front fees. The affordability of finance remains a key issue in terms of accelerating demand for charities.

Clickhere for a full version of the report.

Phi in Numbers April 2014

Of the 485,767 records on Phi as at the end of April 2014, a total of 31,141 (6%) are attributed as company donations. Of these 4,191 (13%) have exact known donation amounts with total donations from this group alone amounting to in excess of £194m (at an average of £46,393 per donation). Extrapolating this figure across the donations without known amounts suggests estimated total corporate donations represented on Phi of around £1.4bn.

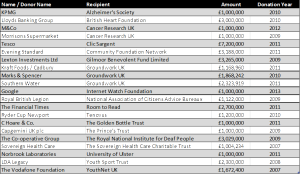

There are a number of sizeable corporate donations represented on the database with 24 donations in excess of £1m. Of these, the top three are:

- Investment management firm Rensburg Sheppard LLP contributed £36m to the National Garden Scheme over 17 years of partnership with the charity between 1994 and 2010. They remained involved with the scheme under their new name of Investec. The contribution does, however, appear to include money raised from entry fees and other associated sales rather than being entirely donated by the firm.

- Morgan Stanley donated £10,400,000 to Great Ormond Street over a three year period between 2008 and 2010. The money went towards the Morgan Stanley Clinical Building and includes sums raised by the company’s employees. The building was opened by Lord Coe in June 2012. The final sum raised at this point was £11.5m – exceeding the original target of £10m.

- Otto Schiff Housing Association donated £10m to Jewish Care in 2006-2007. We see an Otto Schiff dementia care unit within the organisation’s Maurice and Vivienne Wohl Campus at Golders Green. The housing association itself closed down in 2011, with the funds raised from the sale of its assets being contributed to a range of Jewish charities.

Of the remaining £1m+ donations (listed below) we note in particular the success of Groundwork UK in attracting sizeable donations from three separate corporate organisations in 2010 and 2011 – Kraft, M&S and Southern Water.

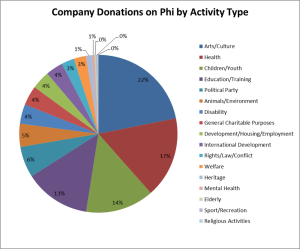

Phi suggests that the charitable sector which has attracted the highest number of corporate donations in recent years is Arts & Culture (22%), followed by Health (17%), Children/Youth (14%) and Education/Training (13%).

Whilst the low number of corporate donations to Religious Activities is to be expected, it is perhaps somewhat more surprising that corporates appear relatively unlikely to support Sport/Recreation, Mental Health, Welfare and the Elderly.

Variations in naming conventions (such as Ltd/Limited or &/and) make analysis of the most often mentioned companies somewhat imprecise. However, it would seem that the star corporate performer in the UK is the various forms and divisions of Barclays Bank plc (including Barclaycard, Barclays Capital, Barclays Corporate and Barclays Wealth Management) with a total of 329 Phi records. This may reflect a tendency for the bank to offer corporate donations rather than the foundation based schemes of some of its competitors.

Other companies with over 50 Phi records include Deutsche Bank, Accenture, GlaxoSmithKline, KPMG, Royal Bank of Scotland, Goldman Sachs, Norton Rose Group, Morgan Stanley, Bloomberg, HSBC and BT.

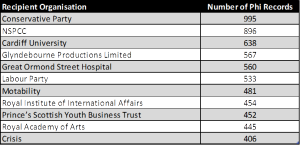

And Which Charities Attracted most Corporate Donors?

Phi suggests that the recipient organisations which have been most successful at attracting corporate donations in recent years include – relatively predictably – the Conservative Party, NSPCC, Great Ormond Street and Glyndebourne.

More unexpected perhaps are the high number of corporate donations being received by Cardiff University (making it the top academic institution), Motability and Crisis. We see a wide range of companies donating to all three of these organisations with Crisis being particularly notable for its apparent fundraising strategy of attracting a relatively large number of small donations.

Notes

- Analysis is based on all Phi records as at 30/04/2014 which have been given a ‘Company’ donor type.

- Where multiple Activity Types apply, analysis is based on the first listed activity type.

- Company and Recipient names have been adjusted from the original record in some cases in order to aid analysis.

Profile: The Ernest Cook Trust

Founded in 1952, the trust was created by Ernest Cook, whose grandfather, Thomas Cook, rose from humble beginnings to eventually become the head of the internationally successful Thomas Cook Travel Agency.

Ernest’s father, John Cook, went to work for his father’s firm and as time went on, his sons Ernest, Frank, and Thomas Albert also joined the family business and played their part.

Thomas Albert had a fairly conventional role in the family business until his retirement, after which, his two brothers acquired his share. In comparison, both Frank and Thomas had two very different approaches in contributing to its success.

Frank Cook, who was the most adventurous of the three, enjoyed travelling and became an agent for the company in the more remote and exotic parts of the world. In comparison Ernest, who was a shy and retiring man, chose to work in the banking department of the firm’s main office in London. It was here that he worked on developing the banking and foreign exchange side of the business, a position he held for more than 30 years.

Ernest retired in 1928, and he and his brother sold the firm to the Belgian company Compagnie Internationale des Wagon Lits for £3.5m.

Needless to say, the sale of the business made the brothers extremely wealthy, and allowed Ernest to pursue his varied personal and philanthropic interests, including the eventual foundation of the Ernest Cook Trust in 1952. Once retired, he devoted the remainder of his life to the preservation of English country houses and estates, along with the prized paintings and furniture that were contained therein.

Being a Londoner born and bred, his passion for landed estates and the countryside in general was somewhat surprising. However, it is understood that he had a deeply sentimental and somewhat romantic view of what is called ‘old England’. He was a connoisseur of both art and architecture and upon his death in 1955, nearly 100 different museums and art galleries throughout England benefited from his generosity. His retirement home, No1 Sion Hill, was bequeathed to Kingswood School in Bath, in accordance with his wishes.

Towards the end of his life, several of his remaining country estates were also either assigned or bequeathed to the Trust, and a number of others have also come under its management as time has gone by.

For the financial year ending the 31st of March 2013, the foundation reported an income of £3,694,742 and an expenditure of £3,944,476. Factary Phi holds 127 records of donations made to various organisations since 2006 worth a minimum of £185,558.

For this trust, the largest single donation to have been recorded in Phi is an £11,000 gift made to Sir John Soane’s Museum in 2013, and it terms of its donations made to various different activity types in Phi, the overwhelming majority have been made to Arts/Culture related causes (80), followed by Education/Training (26), Environment (13), Heritage (4), Children/Youth (1), Health (1), Development/Housing/Unemployment (1), Disability (1).

The Trustees

Harry Henderson

Harry Henderson is a stockbroker and the son of Major John Ronald Henderson. As a stockbroker, he is Chairman of Witan Investment Trust plc and a former Managing Director of Cazenove & Co, also an investment management firm. He is currently a trustee of the Farmington Trust Ltd, The Winston Churchill Memorial Trust and The Sarah Henderson Memorial Fund.

Miles Tuely

Miles Tuely is a semi-retired land agent who has held positions with Cluttons and also as a Director of Savills in Oxford. He is also a Trustee of the Nuffield Oxford Hospitals Fund and The Keys College Of Radionics.

Samuel Bosanquet

Samuel Bosanquet is listed as a landowner and he is also a Director of ECT Farms Ltd. On Factary Phi, we find three donations made by him to Keble College, The University of Oxford.

Dr Victoria Edwards

Dr Victoria Edwards OBE is a rural chartered surveyor and a senior lecturer in real estate and planning at Henley Business School, The University of Reading. She is also a board member for Forrest Holiday LLP and a council member of the Winston Churchill Memorial Trust. Prior to this, she was a Forestry Commissioner and a non-executive Director of the Countryside Commission. She is also a trustee of the Downham Trust.

Andrew Christie-Miller

Andrew Christie-Miller is currently Chairman of Hambleton Vinyard plc and he is a former owner of the Clarendon Park Estate in Wiltshire. Prior to this, he was a chartered surveyor with Savills and he has also held a number of senior positions, including as Wiltshire County Councillor, High Sheriff of Wiltshire and Deputy Lieutenant of Wiltshire.

Patrick Maclure

Patrick Maclure, also semi-retired, is a former schoolmaster who is Aide to the Warden and Headmaster at Winchester College. Before holding this position, he has held a number of positions with the college, including as a Director of the Friends of the College, and as Old Boy’s Secretary.