Welcome to the June 2014 issue of the Factary Phi Newsletter.

Major Giving News

Museum nets £5m donation

London’s Natural History Museum is set to receive the largest single donation in its history from philanthropists Sir Michael and Lady Hintze.

Sir Michael, who is the founder of asset management firm CQS and a Conservative party donor, said it was a privilege to donate the funds, stating that:

‘Our gift recognises the museum’s great value as a cultural and scientific institution, enjoyed by millions including ourselves. We feel privileged to be able to make a contribution towards securing this centre of scientific knowledge and research for present and future generations.’

The museum’s Director, Dr Michael Dixon said that the donation represented a ‘big step towards ambitious plans, and also added that:

‘Sir Michael has a long and most distinguished record of philanthropy, supporting culture and the arts alongside many other good causes’.‘This donation, however, is extraordinary not simply in terms of its scale, but also as a truly magnificent example of philanthropic investment. It will have a real and lasting impact on the Natural History Museum.’

Factary Phi holds upwards of 40 individual donations made by Michael Hintze, principally to the Conservative Party, with several donations listed each year between 2007 and 2012 of between £1.5k and £125k. Phi also lists donations made by the Hintze Family Charitable Foundation, of which Michael is the founder and trustee, principally to organisations working in arts and culture but we further note donations of over £1m to The Prince’s Foundation and the Friends of Harvard University and one donation of £2m to the National Gallery.

Golfer donates £1m

Through his personal foundation, Rory McElroy is set to donate £1m to the Cancer Fund for Children in support of the charity’s rest and respite home, Daisy Lodge.

Speaking on his decision to donate the money, McElroy said he was ‘overwhelmed by the honesty, courage and warmth of the children and teenagers there and immediately made the decision to enhance my support of the charity’.

The facility opened last month, and is considered to be the first of its kind in the UK and Ireland, by providing free short breaks for up to 500 families affected by cancer every year. The money will be distributed over a 4 year period, and will be used to cover the running costs of the facility.

University to receive £40m

Imperial College London is to receive a staggering £40m donation from philanthropist and businessman Michael Uren.

His donation will be used to fund the construction of the Michael Uren Biomedical Engineering Hub, which will house state of the art research into new and more affordable medical technologies.

Speaking on the donation Sir Keith O’Nions, who is President of Imperial College London, said: ‘Imperial is profoundly grateful to Michael Uren and his Foundation for this remarkable gift, the most generous it has ever received. It will create a wholly new building and set of facilities for engineers and medics to come together and make new discoveries and innovations on an unparalleled scale. It provides enormous impetus to the development of Imperial West as an innovation district.’

Michael Uren said: ‘It is an honour for me to be able to help this great university. Medical teaching and research didn’t exist at Imperial in my day, but it has evolved into an institution where the work between engineering and medicine is today one of its outstanding strengths. Imperial has always applied academic excellence for the greater good, and I am thrilled by the prospect of this Biomedical Engineering Hub doing exactly that.’

On Factary Phi, we can see that Michael Uren has also made a variety of other donations (68 records) through his personal foundation. Examples include St Dunstan’s, the Imperial College Trust, The Royal British Legion and more.

Report: ‘Managing in the New Normal’

The seventh edition of the report is entitled ‘Managing in a Downturn’ and the research for it was produced by PwC, the Charities Finance Group and the Institute of Fundraising.

The political and economic backdrop

For last year’s edition the report, the research was focused upon understanding the implications of the cuts in public spending that were promised by 2014/15, and also how charities were adjusting to the ‘new normal’ of relatively weak economic growth and consumer spending, inflation and uncertainty. This year’s survey provides a glimpse into whether the much anticipated economic up-turn is being felt by charities, and how this affects their plans.

During 2013 the UK’s economy began to show cautious signs of recovery. During this time, the Bank of England’s new governor, Mark Carney, also introduced the concept of ‘forward guidance’ in order link interest rates to unemployment, which in turn provided some reassurance for markets, particularly for those who benefited from the record lows in interest rates, now entering their fifth year at 0.5%. Furthermore, unemployment also fell and by the beginning of 2014, inflation was below the Bank of England’s 2% target for the first time in more than 4 years.

For charities, this trend of economic recovery can obviously be seen as encouraging, and indeed, this sense of ‘cautious optimism’ is reflected in this survey, with roughly 70% of respondents expressing a sense of optimism for the next 12 months.

The current environment – key findings

- Charities continue to believe that government policies have failed to have a positive impact on their operating environment. 45% of respondents reported that government policies have had a negative impact on their charity overall, in the last 12 months. More specifically, 43% reported that policies had led to a detrimental impact on funding.

- Demand for their services has continued to increase year on year, as is to be expected. With 69#37; reporting an increase in 2013, and 68#37; expecting this to continue to rise.

- From those expecting an increase, 30% felt equipped to deal with the pressure, 27% felt they could deliver more with the same resources, and 16% anticipated the need to make cuts in other services in order to meet the additional demand.

- Charities felt increasingly under the spotlight in 2013, with 90% of respondents stating that the sector had become subject to more media interest and scrutiny

- Public sector funding, trusts, lottery & foundations and trading continued to be reported as the most important income sources for charities

Responding to the current environment

The point is made in the report that, although charities are expecting to see continued increases in the demand for their services, they appear to be noticeably less anxious about their income sources than in previous years. So therefore for charity staff and trustees, this change in circumstances may pose some interesting questions. For example, can organisations that have had to impose pay freezes in previous years now think about offering a pay rise to staff? Is there more of an appetite for social investment?

Questions such as these must be carefully considered by charities who wish to navigate the year ahead and make the best possibly decisions for themselves. To provide a useful indication of how these charities are feeling about their future work in this environment, respondents were asked to provide their views on expected changes to their income, fundraising activity, their financial plans, and also on what they think about the public scrutiny of charities and the morale of their workforce.

More than half of those surveyed reported that they plan to diversify their income in the next 12 months, which indicates that although a more positive environment may be on the horizon, there is still some way to go before this is reflected in income. 68% of respondents reported they had performed some sort of strategic review and almost 40% have had to use their reserves in the past 12 months.

In terms of planning for their future, there was an overall 7% increase in respondents who intended to start fundraising in new areas as well as in current areas of focus compared with previous years. Similarly, there was a decrease in protective or reactive actions taken, such as cutting back on grants given and redundancies, providing a somewhat more positive perspective for 2014.

Based on the responses, it appears that organisations are still planning on developing their income streams and diversifying to ensure sustainability, the responses indicating that these organisations are better placed to achieve success and are more optimistic about the future.

Fundraising – key findings

- Overall, respondents felt that the fundraising climate is a less daunting compared with last year, and there has been a drop in those who thought it would get tougher in the next 12 months

- 38% of respondents plan to increase training for fundraising, almost double the amount in the previous year

- In terms of challenges to fundraising, competition from other organisations was considered to be the biggest worry

- 55% of respondents plan to diversify their income in the next 12 months

Collaboration – key findings

- 4% of respondents had decided to merge with another organisation during 2013, and a further 15% were considering merging in 2014

- Collaboration between charities remains a popular activity, with 77% of respondents claiming that they had either partnered with others, or were considering doing so

- Joint programmes of service were found to be the most common form of collaboration

- The idea of a merger between organisations remains valid for some charities, with 15% of those surveyed now considering this. The proportion of charities that have merged in the last year has stayed stable from last year, at 4%.

People and strategic review – key findings

- 44% of the charities surveyed reported an increase in staff in the last 12 months, suggesting some steady growth

- 26% of charities reported a decrease in staff, almost the exact same proportion as last year

- Just over half of those surveyed (55%) found the mood of staff members to be energised and optimistic

Reserves – key findings

- A significant proportion of charities (44%) continue to draw on reserves, 31% have definite plans in place to utilize their reserves in the coming year, and a further 23% were considering it as an option.

- As was also the case last year, the majority of those charities were planning to use their reserves to either maintain their existing services, or (48%) or cover their operating costs (41%).

- The level of reserves held by charities has remained the same over the last two years

- Of those charities that were not using their reserves, 55% stated this was because there was no need and 20% said they did not have sufficient reserves that could be spent. The most common reasons given for this were reluctance from trustees (23%), and ‘management’ (16%)

Transparency – key findings

- 90% of respondents stated that, over the last year, the charity sector has become subject to increased public scrutiny and media interest

- According to the responses this trend looks set to continue, with 87% believing this will increase even further over the next 12 months

- Half of the charities surveyed have taken steps to enhance their level of transparency and disclosure of financial information over the next 12 months

Social Finance – key findings

- According to the responses, Interest in repayable finance or social investment products has remained low, with 83% of respondents reporting that there has been no change in their charity’s interest in them. Last year, 79% expressed that they had not even considered it

- 72% stated that they had not used these products simply because they did not need them

- 14% cited management and trustee discomfort for taking out loans as a reason for not considering these

Conclusions

In the main, responses to the survey suggest that the overall financial environment is beginning to look positive for charities, as many organisations have begun to find ways of coping and becoming more sustainable.

Charities appear to be more optimistic about their future, which is obviously good news. However, it is important to remember that there are many challenges still remaining, and the point is also made that charities must continue to improve, and use all of the information available to them to order to give them the best possible chance of survival. For those charities that are able to remain robust and well managed, it is thought that there are some substantial opportunities still remaining that will enable them to continue meet the increasing demands placed upon them.

Clickhere for a full version of the report.

Phi in Numbers May 2014

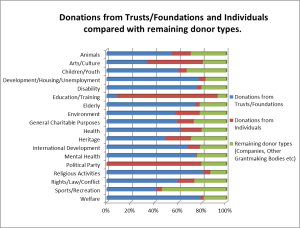

For this month’s edition of our database update, we have decided to take a look all donations in Phi made by Trusts & Foundations and also Individuals Donors to various activity types across the database.

It should be noted that the data represented here is based on data available in Phi and as such, it is not necessarily representative of the wider giving sector as a whole.

For reference, Phi currently holds 245,166 records of donations from Individuals and 145,798 from Trusts & Foundations, representing a combined total 390,964 donations.

Below, we have included a bar chart which displays the proportion of donations from both of these groups to each activity type.

As is evidenced by the graph above, donations from these two donor types combined make up the most significant proportion of almost all donations made to each activity type across the entire database, with the only exception to this being donations made to Sport/Recreation related causes.

When only donations from Trusts and Foundations are considered, these appear to make up the majority of donations in almost all areas of the database, the most significant of which being Religious Activities, representing 7,546 records of donations (81% of donations in this category).

In comparison, those from individuals appear to account for a significantly lower percentage of donations in almost all areas (at least, in terms of the number of records in the database). However, it is interesting to note that this is trend is broken in few areas, namely in the case of Political donations, Arts/Culture related causes and most significantly in the case of Education/Training, wherein 183,391 records of donations from individuals account for 84% of all donations in this category.

Profile: The Sir James Knott Trust

Formed in 1990, this trust was founded by the family of Sir James Knott, a notable businessman, shipping magnate and politician based in the north-east of England.

The eldest of 10 children, James was born in 1855 and was educated at the Scotch School in North Shields. He left school at the age of 14, and soon began working as a shipping clerk on Newcastle Quayside. Following on from this, he began working as a shipbroker and soon acquired his first steam ship in 1881, naming her the ‘Saxon Prince’.

This was to be the first of many, and by the year 1886, Sir James owned 17 ships and had also purchased his first tanker. He set up shipping company Prince Line Ltd in 1895, and it would go on to become the third largest shipping in the world, with 45 ships in its service.

Aside from his considerable shipping empire, he also had many other personal and business interests, including owning coal mines, becoming a ship’s master, studying law and serving as a politician and MP for Sunderland.

To further his philanthropic interests, he also formed his own investment company Samares Investments, and he and his family were great benefactors to the North East of England and in particular, the village of Heddon on the Wall. He married his wife, Margaret Garbutt in 1878 and the couple had three sons, Thomas, James and Henry Knott.

Sadly of their three sons, only the eldest, Thomas Garbutt, survived the Great War. Sir James died in 1934, and his son then inherited his father’s title. He in turn married Margaret Annie Anderson in 1925 but there were no children from their marriage, and most of his estate was left to the Trust set up by his father, Samares Investments.

For the financial year ending the 31st of March 2013, the trust reported an income of £1,466,735 and an expenditure of £1,850,884. Factary Phi holds 135 records of donations made to various organisations since 2006 worth a minimum of £827,650.

According to Phi, the average size of donations made by the trust is £6,130, and the largest single donation has been made to Newcastle University for £125,000. The largest proportion of donations have been made to Children/Youth related causes (30), followed by Arts/Culture (20), Health (15), Development/Housing/Employment (14), Education/Training (13), General Charitable Purposes (11), Welfare (8), Sport/Recreation (8), Environment (4), Disability (3), Religious Activities (2), Heritage (2), Elderly (2), Animals (2) and International Development (1).

The Trustees

Ben Speke

Ben Speke is a financial advisor who has previously held positions as a Director of investment management firm Brewin Dolphin, a Partner and a Director of Wise Speke, and as an Institutional Salesman at Hoare Govett.

Lady Sarah Riddell

Lady Sarah Riddell has a background in journalism and arts publishing and she is also holds trusteeships in a number of different charitable trusts and foundations, including: The Sir James Knott Trust, the Pilgrim Trust, the Sir James Knott Trust, Cicely Saunders International and the Castle Auckland Trust. Prior to this, she served as Vice Chairman of the Hammersmith Hospitals NHS Trust, and as a lay member of research ethics committees and of a government advisory body on clinical trials.

Oliver James

Oliver James is an Emeritus Professor of Hepatology with the University of Newcastle upon Tyne and he is also a consultant physician for the Newcastle upon Tyne Hospitals NHS Trust, and a deputy Director of the Institute for Ageing and Health.