Welcome to the March 2015 issue of the Factary Phi Newsletter.

Major Giving News

London Freemasons donate £2m

London Air Ambulances are set to receive a massive £2m donation thanks to the London Freemasons.

The money will be put towards the purchase of a second emergency helicopter, which will in turn be used to deliver an advanced trauma team to critically injured people in London. Despite the £2m donation however, a further £2.35m is still required to make the service a reality.

London’s Air Ambulance CEO Graham Hodgkin said, ‘We are blown away by the generosity of the London Freemasons. The £2m brings us significantly closer to realising our goal of having a second emergency medical helicopter up and running as soon as practicably possible. Nationally, the Grand Charity of the United Grand Lodge of England has been donating to the air ambulance community for some years. Thank you to all those across the London lodges who will be working tirelessly to raise this additional £2m target.’

Homeless veterans net £300,000

Lloyds Banking Group has donated £300,000 to the Independent Newspaper’s The Homeless Veterans campaign. Donations have also been made by its readers and sister newspapers The Independent on Sunday, I and the London Evening Standard.

The campaign is intended to assist ABF The Soldiers’ Charity and also Veterans Aid in their mission to help former serviceman who have struggled to re-adjust to society and who need support.

Speaking on the bank’s donations, Lloyds’ chief executive Antonio Horta-Osorio said: ‘The Independent’s campaign will help improve the lives of those men and women of the armed forces who have risked their lives to serve us all. Lloyds Banking Group is deeply honoured to add its ready support.’

Thanks to their donation, the campaign has now reached its target of £1m.

Simpsons co-creator donates $100m fortune

Sam Simon, who was a co-creator and a producer for The Simpsons cartoon has died aged 59 after a battle with a colon cancer. After being given only 3 months to live, he chose to donate his entire $100m fortune to charity.

Various charities are set to benefit, including PETA, Save the Children, the Sea Shepherd Conservation Society and also his own Sam Simon Foundation, which supports veterans suffering from post-traumatic stress disorder and also the hearing impaired through the use of special service dogs.

Speaking on his decision, he said that: ‘I get pleasure from it. I love it. I don’t feel like it is an obligation’. Adding that: ‘The truth is, I have more money than I’m interested in spending, (…) everyone in my family is taken care of, and I enjoy this’.

Report: An Independent Mission: The Voluntary Sector in 2015

This month, we have included our summary of several chapters of a recent report on independence in the voluntary sector. The report is entitled ‘An Independent Mission: The Voluntary Sector in 2015’ and the research was initiated and funded by the Baring Foundation. This is its fifth and final edition.

The Context for Independence – The voluntary sector widely valued by the public

According to the research, a large and still growing proportion of the public consider the voluntary sector to be absolutely essential, with 76% of those surveyed stating this in 2012 compared to 63% in 2005. Three out of five teenagers also said that charities and social enterprises are having the most impact in their communities, compared to one in ten who cited politicians.

Indeed, when these two groups are compared in terms of their relative level of service to the community, it appears that voluntary organisations can simply engage with communities in a way that politicians increasingly cannot. According to IPSOS MORI, every year between 2005 and 2013, the level of trust in the voluntary sector has remained consistently high, with 60% of those surveyed agreeing. In comparison, faith in politicians has fallen over time and remains low, at below 20%.

An increase in social demand

While public trust in charities appears to have remained relatively consistent, the demand for their services in recent times has continued to rise. This is evidenced in a number of ways, such as the dramatic increase in the demand for foodbanks, the rise in the number of homeless people in the UK and the developing crisis in mental health.

In the face of increasing cut backs to its services and benefits, there has also been an increasingly reliance on the services of charities by the government, as these services become more required in order to fill the funding gaps that have been left behind.

A fall in income and public sector funding

The state support that does still exist for these types of services has also been noticeably diminished, as this income has been shifting from grant funding to contracts. In 2011-12 the total income for UK charities fell by £700m to £39.2bn, representing a drop of 1.7% in real terms.

UK charities have also lost over £1.3bn in income from the government in 2011-12 (the latest year available), representing a reduction of 8.8% from the previous year. Furthermore, more than 80% of government funding received by charities in 2011-12 was in the form of contracts for delivering services rather than in the form of grants, compared to just under half in 2000-2001.

Partly due to the relative difficulty for the voluntary sector in gaining contracts, the loss of statutory income to the sector in 2011-12 was found to be worse than the NCVO originally estimated. These cuts will continue until at least 2017-18, and they are revising their forecasts for the period.

Smaller organisations are under more threat

It was concluded in the NCVO’s 2014 Almanac that:‘Wealth in the sector is hugely concentrated. All too often the most dynamic community-based local charities are losing out to large, professionalised national ones.’

This is significant, and the Almanac also noted that the proportion of the sector’s total income which goes to charities with an annual income of £100,000 or less fell from 5.4% in 2006 to 3.5% in 2013.

Based on this and some secondary analysis carried out on NCVO figures, it is clear that smaller organisations are under increasing threat as a result of losing out so much both in terms of income and in terms of statutory funding. The Centre for Social Justice also undertook similar research, looking at 350 small, community based organisations fighting poverty in the UK, and according to their findings, 1 in 5 were at risk of closing their doors due to a lack of funding.

Sources of power

It should also be noted that many smaller organisations may be under threat as a result not only of the increasing financial difficulties they face but also due to the far larger organisations having access to more ‘brand’ and more financial power that comes from high levels of public recognition, support and diverse sources of funding.

The international context

Looking internationally, the wider picture is that corporate power has gained an increasing influence over the sector. A Charities Aid Foundation report concluded that while the independent voice of the sector is highly valued by the global public, ‘not-for-profits around the world are facing an increasingly hostile legal environment for advocacy, with governments moving to restrict their ability to speak out’ on the relevant issues.

In Canada for example, the regulating authority has ruled that Oxfam cannot have ‘prevention’ of poverty as a charitable objective, and instead the ‘alleviation’ of poverty is what it should be concerned with. The report notes that in many developing countries, voluntary bodies are increasingly being pushed into becoming an arm of the state, or bodies that are to be seen and not heard.

Looking ahead

Looking ahead, while there are some considerable risks to the independence of the sector, there could also be a potential turning point if the sector can seize the agenda and find more effective ways of working with the state.

A changing state

All the main national parties have stated they are committed to cutting public expenditure dramatically, and David Cameron has also signalled that he believes a smaller state is inevitable. While the government has been seeking to encourage philanthropy, analysis in a recent report has shown that this increase is showing no signs of being sufficient to fill the gaps already left by cuts in statutory funding. Furthermore, new funding is unlikely to reach the areas that need it most on current trends.

Review of six key challenges

Loss of identity and respect for independence – Verdict: continues to get worse

Last year, the Panel called for ‘visible leadership and practical demonstrations from the Government’ in order to demonstrate their respect for independence. Since that time, two ministers were appointed in six months to the role of Minister of Civil Society and, the report notes, we have seen the increasing appropriation of volunteering as a ‘workfare’ tool by the Government and the first signs of steps by the Charity Commission to differentiate between charities receiving public money. Introduced by the Commission, a new requirement for charities to declare their public funding in their annual returns may aid transparency, but this could also be seen as a ‘backward step’ if this re-enforces the view that publicly funded charities cannot (or should not) be fully independent from the state. On the plus side, there are increasing signs that the sector is starting to articulate its own contribution.

Threats to Independence of Voice – Verdict: Threat level increasing year on year

In its previous report, the panel expressed concerns about the so-called Lobbying Bill, gagging clauses in contracts and self-censorship. The panel called on the government to:

- Engage fully with the sector when the impact of the new provisions in the Lobbying Act are reviewed after the election

- Safeguard voluntary organisations ability to take judicial reviews and intervene in them

- Outlaw gagging clauses

Unfortunately in 2014, there has been no evidence of a positive shift in the government’s stance in these areas, and in some respects the situation may even have worsened. The panel was also concerned by the negative views of the sector expressed by some senior Government ministers. However, despite this attitude which could potentially contribute to a climate of self-censorship, it is considered positive that the sector has at least acted to defend itself against attacks.

Lack of Consultation and Involvement – Verdict: Continuing to worsen year on year

In the last report, deep concerns were raised regarding the government’s decision to remove the minimum 12 week consultant period on key proposals. A National Audit study also found that the percentage of consultations running for less than 12 weeks doubled. Based on the evidence, it appears that consultation and genuine involvement in government policy is becoming increasingly challenging for the sector.

Statutory Funding and Contracting Arrangements – Verdict: No significant improvement

The panel has previously expressed concerns that statutory funding is not supporting a strong, independent and diverse sector, with particular problems for smaller, local organisations.

Since then, while there have been some positive developments, particularly with the implementation of the Social Value Act 2012 and the new EU procurement regulations, the Panel remains concerned that the existing funding model deployed by the state for working with the sector does not sufficiently support a fully independent, diverse sector.

Ineffective Safeguards and Regulation – Verdict: Worsening

In its previous recommendation, the panel called for the Government to ‘compact proof’ new policies and ensure that the Charity Commission is equipped to carry out a strategic role. Unfortunately, its concerns regarding the effectiveness of the Charity Commission persist, and the compact has not yet been effective in protecting the voice of the sector or adequate consultation.

Greater protection for independent governance – Verdict: no overall improvement

The panel has called for the introduction of regulations, similar to those in Scotland, which will reduce the capacity for interference by the state in independent governance. Since the last report, there has been no change, and there remains in issue in relation to a whole category of public functions, including museums and galleries, which are nominally charities but are tightly controlled by the government. The panel has also continued to hear instances of local authorities who are seeking to exercise some form of control over local voluntary organisations.

Recommendations

Whichever government comes into power in the UK in May 2015, there must be a re-evaluation of the relationship between the state and the voluntary sector. The panel recommended action in the following areas:.

- A removal of the constraints on independence of voice and protect the legitimate right of voluntary organisations to campaign, repealing the Lobbying Act, reversing changes to judicial review and removing ‘gagging clauses’

- Establish a formal mechanism for dialogue and collaboration between the government and the sector, both locally and nationally

- Reform commissioning and procurement in order to get the best out of the sector and recognise its value. Involve the sector in drawing up new contracts

- Provide the sector with targeted financial support, particularly for smaller organisations that work with the most disadvantaged and most at risk groups

- Introduce stronger safeguards that will protect independence, including a recast and more effective Compact. This should be enforced by an independent body which reports to parliament, and both the Charity Commission’s political independence and the sector’s right to campaign should also be ensured.

Clickhere for a full version of the report.

Phi in Numbers March 2015

For this month’s edition of our Database Update, we have decided to take a look at donations made to the Rights/Law/Conflict activity type in Phi, and to see if there are any particular patterns or trends in terms of donation size and the types of donors who support this field.

At present, there are 5,394 records of donations that have been made to Rights/Law/Conflict related causes in Phi, and these are spread over a 10 year period between 2004 to 2014. On average, this amounts to 539 records of donations per year, however there is also a notably higher proportion of donations that have made to this category between the years 2007 to 2010.

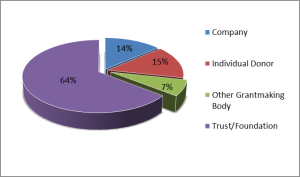

Below, we have included a pie chart displaying the spread of donations made into this category from Phi’s four main donor types: Individuals, Trusts & Foundations, Companies and finally Other Grant-making Bodies. (Donations from Celebrity Supporters/Ambassadors, Presidents/Vice Presidents, Trustees and Patrons are considered as Individual Donations).

As is demonstrated by the above chart, the vast majority of donations made into this category have come from Trusts & Foundations, representing well over half of all donations made to Rights/Law/Conflict related causes throughout the database (3,825 records), this is followed by Individual Donors (874), Companies (810) and finally Other Grant-making Bodies (424).

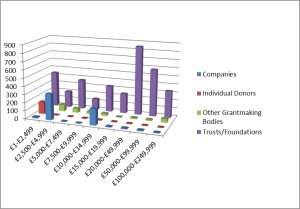

While records from Trusts & Foundations make up the majority of this activity type at least in terms of donation frequency, we thought it might also be interesting to include some information on donations to rights/law/conflict causes according to donation size (£). However it should be noted that only those donations with an amount or gift band lower have been included in this second chart.

Perhaps unsurprisingly, the lion’s share of donations (or at least, those which include an amount or gift band lower £) have also come from Trusts & Foundations in almost every banding, as is evidenced by the chart above.

This is arguably consistent with the sheer volume of donations coming from the Trusts/Foundations group overall. However, it is interesting to note a relatively high number of donations from Companies have been made in the £10,000-£14,999 and also in £2,500-£4,999, the only (£) banding wherein the largest number of donations have been made by the Companies donor type over Trusts and Foundations.

Profile: CHK Charities Limited

Founded in the year 1995, this trust was established by the family and heirs of Cyril Kleinwort, who was a Partner in the private banking house of Kleinwort, Sons & Co.

The firm was first established by his grandfather Alexander Kleinwort in 1855, however its origins as a business go back further still. Herman Greverus was a merchant who formed a trading partnership with an Edward Cohen in 1851, and this was named Greverus and Cohen until Herman’s retirement in 1855, whereupon Alexander Kleinwort took up his position as a partner alongside Edward in the newly styled Kleinwort and Cohen.

Prior to starting his partnership with Cohen however, Alexander first served an apprenticeship and had also gained experience as a merchant banker in Hamburg. Then, in 1838 he went to Cuba, which during that time was considered a major international trading centre in sugar, coffee and tobacco production. It was here that he first became acquainted with Edward Cohen and future business partner James Drake, who would also join their partnership in 1858.

After Drake’s death in 1871 the firm became Kleinwort, Cohen and Company, with 80% of the capital supplied by Alexander Kleinwort. He also had two sons, Herman and Alexander Drake Kleinwort, who both became Partners in the family business. Under their control, it was renamed to Kleinwort, Sons and Company until 1907.

Alexander also had two sons, Ernest Greverus Kleinwort and Cyril Hugh Kleinwort, who duly joined the family business. Then, in 1960, the company was merged with traders Robert Benson to form Kleinwort Benson, which also became one of the first merchant banks to establish itself in the Channel Islands.

Cyril Kleinwort served as Chairman of the company from 1966 to 1974 and eventually passed away during the year 1980. After the bank was purchased by Dresdner Bank in 1995, his heirs decided to increase the funding for his personal charitable trust, which was also then renamed to CHK Charities Ltd.

For the financial year ending 31st of Jan 2014, the trust reported an income of £2,784,325 and an expenditure of £2,810,001. Factary Phi holds 297 records of donations made to various organisations since 2006 worth a minimum of £2,320,060.

According to Phi, the average size of donations made by the trust is £9,957 and the largest proportion of these donations have been made to causes associated with Disability (52), followed by Children/Youth (45), Arts/Culture (39), Health (36), Education/Training (28), Welfare (26), Development/Housing/Unemployment (14), Elderly and Environment (10), Animals and General Charitable Purposes (5), Heritage and Mental Health and Religious Activities (4), International Development (2) and Rights/Law/Conflict (1).

The Trustees

Charlotte Susanna Heber Percy

Charlotte Susanna Heber Percy is a farmer and she is a Trustee of the Charlotte Herber-Percy Charitable Trust.

Joanna Alice Serena Prest

Joanna Alice Serena Prest is a TV production manager and a Director of Psl Productions Ltd. She is also a Trustee of the Charlotte Heber-Percy Charitable Trust.

Lucy Henrietta Morris

Lucy Henrietta Morris is a musician and a founding Partner in the Andrew Robson Bridge Club Ltd. She is also a Trustee of the Amber Foundation, Nordoff Robbins and Home Start. She is a governor of the Kensington Aldridge Academy.

Rupert Prest

Rupert Prest is a banker and a Director of Standard Bank and The London Platinum & Palladium Fixing Co Ltd.

Serena Elizabeth Acland

Serena Elizabeth Acland is a banker and a daughter of Cyril Kleinwort. She appears to be retired.

Susanna Peake

Susanna Peake is a married lady and a daughter of Cyril Kleinwort. She also has her own, Susanna Peake Charitable Trust, which has a general remit.

Dr Edward Peake

Her son, Dr Edward Peake is a landowner.